By: Bengt Järrehult

The basics of Prospect Theory by Daniel Kahneman tell us that we hate to lose 3 times more than we love to win. This mindset, probably deeply engraved in our DNA, has implications on the way we develop and brand our products as we are more prone to reduce the drawbacks we have relative to our competitors rather than to improve our advantages. According to Bengt Järrehult this leads to commoditization.

Looking at what our competitors come up with is essential. And our competitors do it as well. We all crave for this information in order to plan our own moves better, but how do we do use the information? If we have Brand Alfa in this case, do we work more to increase our strengths vs. Brand Beta or do we work to decrease our weaknesses vs. Brand Beta?

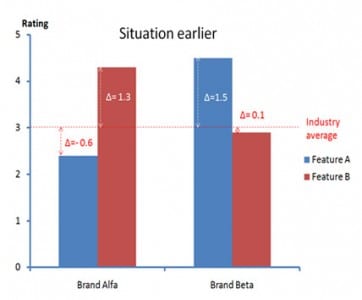

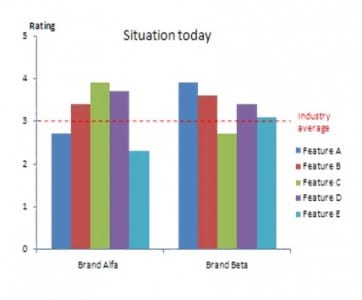

It seems that what happens is – due to flock like behavior (see my earlier post “Commoditization I”) that the difference (∆) between the brand competitors Alfa and Beta in comparison to each other as well as to the industry average decrease with time. The more we measure and observe each other – the more similar we get. The reason is probably that we are more scared to lose the fight vs. our competitors on an identified draw-back in our own brand (as Feature A in Figs 1 and 2) than we are eager to win the fight on our advantage vs. competition. The more we spend resources to decrease our drawbacks the less we can spend to emphasize what we are good at.

If for instance Alfa earlier used to be branded as The Safe Car (safety =Feature A in fig 1) to the cost of lower joy in driving (=Feature B), a feature that Beta used in their branding. Hence Alfa puts a lot of effort in improving their brand towards the joy feeling in driving– but to the cost of branding it as The Safe Car, not in absolute terms, but in relative comparison to industry average. Meanwhile Beta debottlenecked their brand towards improved safety ….leaving Alfa and Beta much less differentiated now, as in Fig 2, than before, as in Fig 1.

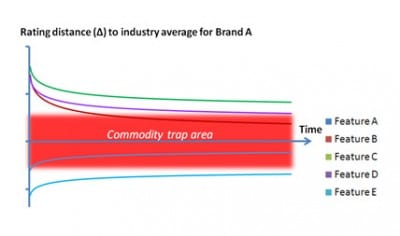

If we look at the 5 features A-F in Fig 3 and follow them over time as in Fig 4, we see an asymptotic move towards “sameness”. This means Brand Alfa gets entrenched into the Commodity trap area with most of its features whereas few of them really stick out. Being in the Commodity trap area means that Alfa and Beta basically only can compete on price.

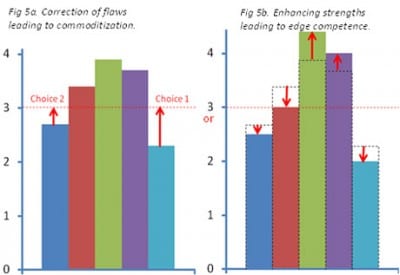

The antidote against getting deeper into the commodity trap is to act according to Fig 5b instead of in Fig 5a. This means that we should bother less on repairing our bad features and instead we should stick out in what we already are recognized in being good at. To be able to act according to this means we have to openly advertise our weaknesses in Feature A, B and F, at the same time we advocate our brilliance in C and D. The draw-backs will be detected by consumers anyway but for those who really appreciate features C and D, they would most likely be able to pay for that extra value.

In order to avoid the perils of entering the commodity trap, you must dare to have a more asymmetric profile of your features than what the competition has. This means focusing on developing what you already are good at instead of focusing on repairing your weaknesses (as long as they are above the “low-water mark”). Long term I believe the market will appreciate this because it makes it easier for customers to choose and it will be easier to strengthen the brand as it is easier for you to communicate. Having an asymmetric profile is especially important in sectors where you aim to be an Innovation Leader!

By Bengt Järrehult

» Download a PowerPoint Presentation for this blog!

About the author

Bengt Järrehult is Fellow Scientist Innovation at SCA, a global hygiene products and paper company. He is also adjunct professor and visiting professor resp. at 2 departments of Lund University in Sweden. He is an avid reader of and presenter on the topics of innovation, especially on breakthrough innovation and the psychological hurdles that exist to achieve this, hurdles that we may or may not be aware of. He is of the opinion that most companies more or less know what to do to become more innovative. What they don’t know is what really hinders them from doing these measures…

Bengt Järrehult is Fellow Scientist Innovation at SCA, a global hygiene products and paper company. He is also adjunct professor and visiting professor resp. at 2 departments of Lund University in Sweden. He is an avid reader of and presenter on the topics of innovation, especially on breakthrough innovation and the psychological hurdles that exist to achieve this, hurdles that we may or may not be aware of. He is of the opinion that most companies more or less know what to do to become more innovative. What they don’t know is what really hinders them from doing these measures…

Photo: Two goldfish in contrasting fish bowls from Shutterstock.com