Let us look into process innovation at work: Late at night in another city, you are off the beaten tracks. How to hitch a ride? Obviously, you don’t know the phone number of the local taxi hotline. So you start walking. There are taxis. You wave your arms, but they are all busy. Things can go wrong in other ways, too. You have the number of a taxi hotline, but they can’t send a cab for 30 minutes. Or there are available taxis only blocks away, but they don’t know you need them.

Einstein once said a good problem description was the essence of a solution. But we have grown so used to living with problems that we don’t even see them anymore. Did anyone have a problem before the wheel was invented? Genrich Altshuller, who developed TRIZ, noticed that inventors had the gift of seeing problems everywhere, problems waiting for a solution.

Several entrepreneurs have spotted the taxi problem: Due to variation in time and space, the demand and the offer remain unmatched. These start-ups have applied process innovation to provide a better solution for both sides—the passenger and the driver. MyTaxi, a German start-up is rapidly scaling up its operations throughout Germany and expanding into Austria, Spain, the US and other countries. Uber offers similar services in San Francisco, Boston, Chicago and Toronto. Hailo is expanding from London into Dublin, Boston and also Toronto. On a recent trip to Denver, I found Taxi Magic, present in over 40 cities in the US. Back in Germany I saw Better Taxi in Berlin – obviously a vibrant market. If the emergence and trajectory of such companies are taking you or the incumbents by surprise, then innovation tools and innovation thinking can help you understand the opportunities and challenges. Launching a new business as an entrepreneur, bringing to market new offerings as an established company or assessing the threats coming from new entrants thus become far more predictable.

Four steps from problem description to process innovation

The first step to fully define an opportunity is to map out specific runs of the existing process. In the example of the taxi service, you would start by meticulously recording how the service is “really” delivered: at a hotel entrance, at train stations, rides hitched by the side of the road or after dinner at a friend’s house. You would interview people, observe their behavior, shoot pictures and draw sketches. The science behind that is “ethnography”. Applying it teaches you what is broken with the current solutions. That helps you scope the innovation opportunity.

“Outcome Expectations” are another powerful guide in defining the opportunity. Outcome Expectations are solution-neutral descriptions of customer expectations. For example, “maximize safety” is a concern for drivers and passengers. Few women drive taxis at night. How could smartphone-enabled taxi apps allow them to be safe? “Minimize commission fees” is another of the drivers’ concerns. Depending on the city in Germany, they pay a monthly flat fee of €300 to €700 to a taxi hotline.

“Remove the middlemen” is a key concept in process re-engineering. Sure enough, to defend their business model based on these fees, large taxi agencies are trying to build regulatory hurdles for the new entrants. Overlooking that in the define phase of an innovation project would be lethal for a start-up.

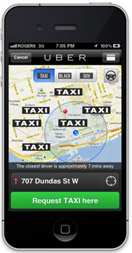

In the next step you discover concepts to design the new process. A powerful guideline is the “radical Lean” question: What is the “ideal final result” of getting a taxi? Easy, click your fingers and there comes the taxi, right? That is a so-called “self-solution”: the taxi arrives by itself, the grass mows itself, the window cleans itself. So which concepts bring us as close as possible to that ideal final result of ordering a taxi? Considering other tools available, you may dive into “resource optimization.” Which free resources are available in the system? You might assume people to have smartphones.

Step three is to develop a “plastic prototype” of your solution. While omnipresent in construction, architecture and the automobile industry, this is a crucial but often overlooked step in creative business work. “Touch and feel” helps innovation teams understand what to pilot and which risks to watch out for.

In the case of the taxi example, the “plastic-prototype” would be the demo-version of a smartphone-app where users press a button—the nearest equivalent to clicking fingers. That sends a message to a server, along with the user’s current GPS coordinates. The server locates the closest available taxi, connected to the server via its own smartphone. If the driver does not accept the ride quickly, the request goes to the next taxi. Users can see who took the ride, along with photo, phone number and the estimated arrival time. Done. Wow!

In the case of the taxi example, the “plastic-prototype” would be the demo-version of a smartphone-app where users press a button—the nearest equivalent to clicking fingers. That sends a message to a server, along with the user’s current GPS coordinates. The server locates the closest available taxi, connected to the server via its own smartphone. If the driver does not accept the ride quickly, the request goes to the next taxi. Users can see who took the ride, along with photo, phone number and the estimated arrival time. Done. Wow!

This is where entrepreneurs tend to fall into a “just do it” mode. That is risky and premature, however. You first need to demonstrate the feasibility of the concept with a “real” prototype. It takes methodology and creativity to design a prototype such that solution concepts can be validated quickly.

Never ever “consider it done”

Those familiar with product development at large organizations will know of the eight- to 12-step “development roadmaps” to produce commercial success out of innovation prototypes. As an entrepreneur, you may not need that entire rigor. But you can learn a lot from the experience built into these roadmaps. While we were using MyTaxi extensively in the summer months of 2012, drivers in Frankfurt were complaining about server breakdowns. That is fixed now. How to ramp up volume is only one critical element in “development roadmaps”. Be prepared to fix lots of hiccups along the way!

You also want to be “out in the field” and observe how your solution is being used. In other words, continue your “ethnographic ” research! Figure 2 displays a taxi equipped with two smartphones. One runs MyTaxi, the other runs a GPS program. The driver explained the MyTaxi application did not integrate well enough with the GPS program. Notice also the digital camera behind the steering wheel. The camera was needed because the driver couldn’t use the smartphone to quickly shoot pictures of critical traffic situations. Someone might just invent a fix for such “compensating behavior” and eventually patent it. It wouldn’t be the first time that a start-up company, after just “clearing the bushes” and getting people used to a solution, was disrupted by a copycat business. Be alert, all the time, to help people get done flawlessly what they expect from your offering.

What’s next?

In a field as crowded as technology-enabled “location-based services”, entrepreneurs can’t afford not to ask “what’s next?” early on. Beyond making their business more robust against glitches, customer-dissatisfaction, competitor moves or regulatory updates, they need to be planning their next step or risk becoming obsolete quickly.

The innovation toolkit offers multiple integrated approaches. The Ansoff matrix helps entrepreneurs and established companies explore four growth quadrants.

| Current job:Bring taxi passengers and taxi drivers together so that a ride takes place. | ||

| Growth opportunities | Current customers: | New customers: |

| Current job: | Quadrant I: Make hitching taxi rides and getting passengers a seamless experience |

Quadrant II: Understand reasons for non-consumption and help potential drivers and passengers overcome them |

| New jobs | Quadrant III: What are passengers and drivers doing before, during and after a ride? |

Quadrant IV: Which key capabilities can be leveraged into other areas? |

Quadrant I relates to the process innovation detailed above, addressing its current jobs that current customers need to get done. In quadrant II, we identify taxi drivers and taxi passengers who have no smartphone or have not installed the taxi application on it. Which are the reasons for “non-consumption”? What would help them overcome these barriers? Barriers often include affordability, knowledge, skill or technology. For taxi passengers without a smartphone, why not use the insight and data gained from the smartphone-app enabled rides to help subscribed drivers predict likely spots of demand?

And why not consider people offering transportation services without being taxi drivers? For decades, Germany’s “Mitfahrzentralen” (ride-sharing agencies) have brought together people driving to distant cities with others in need of a ride. Why not provide such services also within cities by using GPS-enabled smartphones? California has sent several companies that were doing just that, a “cease and desist letter” in August 2012. It may merely be a question of time before someone finds ways around such regulatory hurdles.

Quadrant III is best explored through “job mapping”: What are people trying to get done before, after or during taxi rides? They need to pay. Could they use their smartphones? In collaboration with Lufthansa, MyTaxi has started doing that. With Uber, passengers provide their credit card details while setting up their profiles. Before hitching a ride, perhaps passengers would like to see the “rating” of the driver? Hailo, MyTaxi and Uber offer that. Why not make it mutual? Drivers may also want to see the rating of their prospective passenger to reduce risks and annoyances.

Before people take a cab they also evaluate options. The subway may just be three minutes away from where they are. An integrated “from – to” solution would allow them to choose among various options. Predicted arrival time and price could help passengers make that choice – which may or may not be a taxi, of course.

Taxi drivers also want to analyze their trips: How much money did I make today? How do I convert cost and revenue into a financial statement useful for my tax declaration?

Quadrant IV analysis is often considered the area of “wild innovation,” such as moving from “rubber boots to mobile phones” (Nokia). “Going wild” can spell risk in managing the associated change, though. The growth opportunities in this quadrant should therefore be spotted and analyzed along robust guidelines:

- Look into leveraging your core-competencies. Are you good at matching supply and demand for “location-based services”? What about expanding into restaurant seats then? Why not compete with Open Table under a new brand name like “MyTable”?

- Stay loyal to your current customers’ “higher purposes. The question to ask is: what are people calling a taxi for? The answer: mobility. Which other mobility services could be found there? Could those make even taxi-based solutions irrelevant? Zipcar in the US, Car2go in Germany and others are developing mobility schemes based on “collaborative consumption”.

- Use pre-established criteria to “filter” out the most viable opportunities. Jim Collin’s “Hedgehog principle”, published in “Good to Great”, asks: what are you passionate about, where can you become world-class and where are large markets with juicy margins?

Competitors and non-competitors are also exploring these four growth quadrants. The “glass project” will surely enable Google to offer numerous location-based services. What if Facebook launched an app for taxi drivers with immediate access to zillions of Facebookers? Indeed, exploring the four growth quadrants appears not to be optional for your business.

Entrepreneurs and large organizations alike need sound guidelines when creating new business

You can be lucky; you can also be gifted. If you are like most of us and just want to enhance the odds of your success, then you will appreciate some guidelines to spot opportunities, scope them well, discover useful concepts, develop fast solution prototypes and quickly demonstrate their viability.

If you’re a large organization and need to add a few billions in new products or services to your top line, then there will be no way around a repeatable, teachable and deployable approach to spot promising innovation opportunities and to feed them into your “development roadmap”.

As an entrepreneur you can—and must—be far more agile. But unlike large organizations, you can’t deploy massive knowledge, technology or organizational talent to new business opportunities. In today’s brimming business environment, you need a robust and easy-to-use roadmap, an “Ariadne’s thread” to guide you out of the labyrinth where a “Minotaur” may just be waiting around the corner to eat you for lunch.

Is innovation a buzzword? Some aspects of innovation thinking may be harder to grasp than others. Whatever you call it, innovation thinking must be part of your corporate DNA—or you are leaving the odds of success to those who apply that thinking.

By Dr. Michael Ohler

About the author

Dr. Michael Ohler, Principal at BMGI. Michael holds a doctorate in physics and is a certified Lean Six Sigma Master Black Belt. He is seasoned in shepherding clients through change and innovation processes to help them achieve strategic growth targets. He is an active writer and sought-after international speaker. Together with his family, Michael lives in Hamburg, Germany. He can be reached via michael.ohler@bmgi.com.

Dr. Michael Ohler, Principal at BMGI. Michael holds a doctorate in physics and is a certified Lean Six Sigma Master Black Belt. He is seasoned in shepherding clients through change and innovation processes to help them achieve strategic growth targets. He is an active writer and sought-after international speaker. Together with his family, Michael lives in Hamburg, Germany. He can be reached via michael.ohler@bmgi.com.