Disruptive innovation, with envy and fascination

According to 2013 Deloitte’s Shift Index, a half a century ago the average life expectancy of a Fortune 500 company was 75 years and today it is less than 15 years. It’s heading towards 5 years if “nothing is done.”

This striking insight reveals in part that the conscious process by which information is gathered and used to assist in the decision making at all levels of an organization is technically slower than the pace of progress. The figures are self- explanatory, one piece of explicit information scientifically equals 300,000 tacit ones including anthropology, psychology, sociology, and economics. Further, explicit knowledge is about to double every few years, leaving us with an inexhaustible supply of facts, models, and concepts at our disposal.¹

Today’s organization’s strategic crafting is paired unsatisfactorily. Internally, they focus too much on alignment and short-term results to satisfy the balance sheet, but changes in the industry blindside the firm sooner or later. Externally, there’s too much attention on the adaptability side of the equation, including adequacy and verisimilitude, meaning they’re building tomorrow’s business with the expenses of today.²

In the age of the Internet, organizations are predominately tackling innovation on the incremental level by sourcing value propositions identified as ‘embodied knowledge’ (e.g. electronic solutions are revamping human fallibility because they do not affect the authenticity of the firm). These processes have been productive in the name of competence destruction, e.g. consolidating efficiency, but by social recombination it’s bringing an appealing magnitude of competence enhancement. The latter is scientifically at large, a void, in the light of the “area of displacement”³ put into perspective with pre-paradigmatic, paradigmatic and stable periods of dominant design rules, the latter concluding with the absorption of many entrants by disruptors or established organizations.⁴

Externally, on the tacit front, it seems that organizations explore innovation in an intuitive, exploratory manner, arguably backed by calibrated decision makers. Identified sub-optimal choices are commonly found in asset transformation, synergies, innovative value proposition and volatility of consumer behavior. Yet, outstanding talented business practitioners (e.g. Maurice Levy) could not succeed in fusing Publicis with Omnicom and by the same token, Google Glass remains a circumscribed commercial success.

Independent of the monopoly economy, entrepreneurs enjoy the 300,000 tacit information playing field by virulently acquiring sections in size, scale and efficiencies of established business models, leaving the global economy in profound instability with regards to disruptive innovation.⁵

Furthermore, “the nations,” stretched by the end of WWII equilibrium, are newly domiciled into “embodied cultures” including large geographies implicitly agreeing on a different mix of linguistic, cultural, legal, political and business practices identified as a Social System of Innovation and Production. For example, meso-corporatist SSIP including Samsung, with a distinguished knowledge creation mode, proprietor of universal products, fertile for incremental and disruptive navigation. Or the Public based SSIP Airbus, with key culture centric capable of converging thousands of individual talents in a unique competitive advantage, scorecarded with incremental and disruptive knowledge to play around for a more consolidated duration; and the possible emergence of a new SSIP, “Golf Country Club,” currently flooding outstanding businessmen who are happy to embark onto a fresh high-profit disruptive economy, upon the management of innovation champion Sheiks e.g. Sheik Mesahal Bin Hamad Al-Thani.⁶

Since the “The Innovator’s Dilemma” inductive record, numerous academics have been building complementary theories, but management practitioners were still left without an axiological foundation.

In The Innovator’s Dilemma published in 1997, Clayton Christensen extracted an economic pattern occurring, identifying tensions between actors (i.e. economic maturity of established organizations vs. opportunistic management of outsiders) due to a new set of values applicable in every industry. Since that inductive record, numerous academics have been building complementary theories, but management practitioners are still left without an axiological foundation.

Ultimately, unsubstantiated articles are bringing more injustice to the shoulders of the world. For example, The New Yorker’s article “The Disruption Machine,” June 23th, 2014.

As a set or partial conclusion, arguably, firms lacking a managerial framework are subject to market failures because of resource based imperfections, differing in and out of the equilibrium as they can’t operate in a perfect market.⁷ This incapacity lies in the firm’s inability to captain the technological trajectory tacit side, albeit available. Indeed, boards’ organizational plurality of expertise, hindered by cognitive limitations of the managers’ heuristic decisions attached to their expertise, experiences, networks, cultural misinterpretations and company contract, build upon efficiency and therefore immediate results, alleviate by essence and practice the future of technological trajectory epistemic knowledge distribution.

In that context, boardrooms observe, with envy and fascination, market disruptors and intentional board champions, who are fast absorbing opportunities in the long established efficient economies. In the meantime, on the consumer adoption, the majority of the market is inevitably becoming of disruptive innovation nature in the foreseeable future.

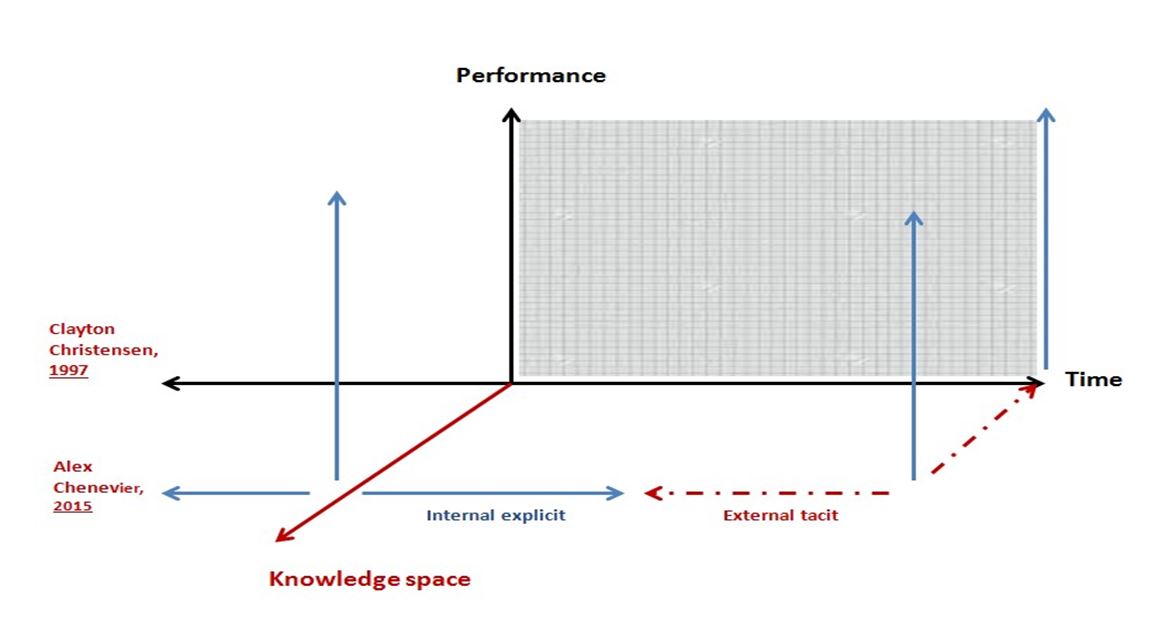

Knowledge space

I have personally been immersed into “samples of reality” or communities within a complex network of social circumstances, political, economical priorities and ideological climate, all together culminating into a “deeper meaning of what the business world is about,” attempting a “unique meaning of business world.”⁸ Explicitly, content knowledge is a continuous augmentation of the global basket of hard sciences, which has been emulating in all industries; incentivized by social purpose along the line of firm history (e.g. Dutch Bicycle, English sports, Japanese Walkman, French Pasteur vaccination).⁹

Researchers have been able to disentangle this relationship i.e. explicit/tacit. It has provided the vehicle for understanding the specific characteristics of the innovation process in any organization.

Explicit information or hard sciences to-date are augmented by tacit fusing i.e. research. Recently, researchers have been able to disentangle this relationship i.e. explicit/tacit, by establishing a systemic dynamic based on a computation of categorized knowledge i.e. know-what, know-why, and Know-how within a firm. Indeed, it is delivering innovation on a systemic manner. It has provided the vehicle for understanding the specific characteristics of the innovation process in any organization.¹⁰

This pillar of research brought a shift in interpretation by opening a company analysis upon three axes, revealing a knowledge space. Indeed, upon the tried adage, “We do not pick up mushrooms at the beach”. Similarly, the opportunity that a Dutch tulip will be subject to research at Microsoft is highly unlikely. It would again otherwise distract the authenticity of the firm.

Therefore we come up with a structuring factor that is definite, therefore exploitable, upon tractability i.e. company specific cognitive distance.

It seizes the opportunity to compile all organizational rents due to the firm’s resources & capabilities i.e. strategic assets, complementarity, scarcity, low tradeability, inimitability, limited substitutability, appropriability, durability.

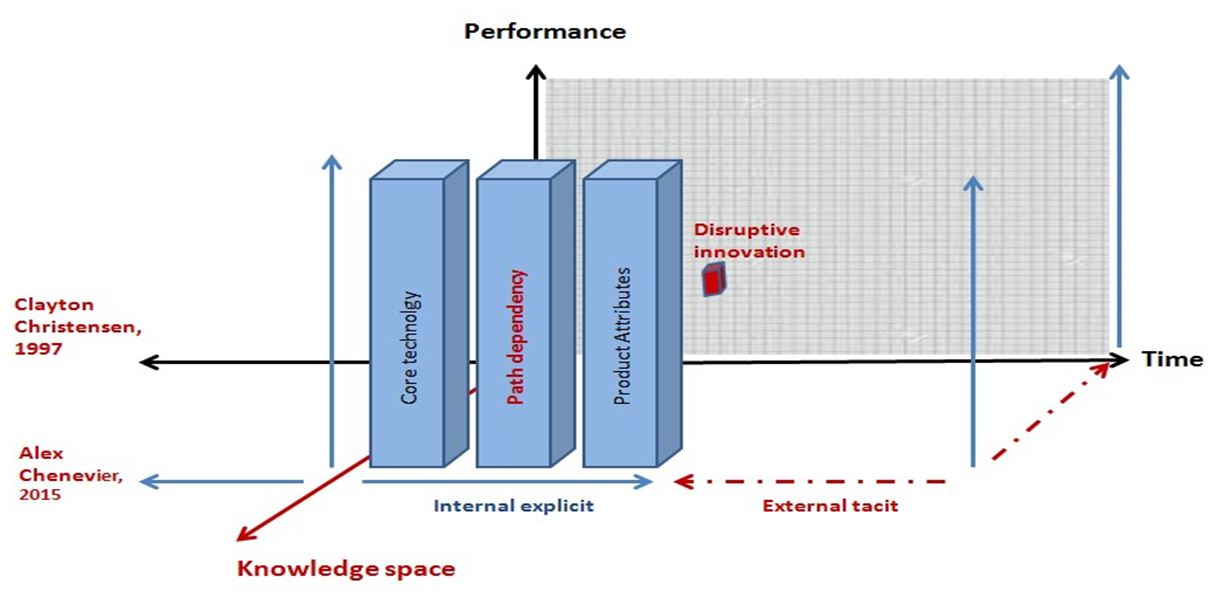

Internal, path dependency

To confound this existing knowledge space into workable business management blocks, Brian Glassman findings in co-creativity balancing common perspectives (procedural knowledge) and extremes perspectives (indigenous knowledge) brought pillar components to fulfill the knowledge space at right angles, around customer exploration, product boundaries, core technology boundaries, market molding, value proposition and synergy with know-how.¹¹

Most of the Fortune 500 have been encountering dramatic changes along the course of their histories, nevertheless a path dependency remains.

The static knowledge filter highlights core technology and the products attributes. These two blocks are in pair spanning the historical technological trajectory and its today’s status i.e. the visible innovation. Its opportunity to make a scientific link is down to the path dependency e.g. unwind continuous accumulation of knowledge. Indeed, most of the Fortune 500 have been encountering dramatic changes along the course of their histories, nevertheless a path dependency remains.

Once this technical diagnostic is established, it gives us variable rationality i.e. a definite identified platform of explicit knowledge legitimately waiting to fuse tacit information on the prospect of absorbing disruptive innovation.

External, disruptive convertible knowledge

Peter Drucker suggests that knowledge is now becoming the one factor of production, sidelining both capital and labor.¹² In the same vein, Abramowitz and David argue that ‘perhaps the single most salient characteristic of recent economic growth has been the secularly rising reliance on codified knowledge as a basis for the organization and conduct of economic activities.¹³

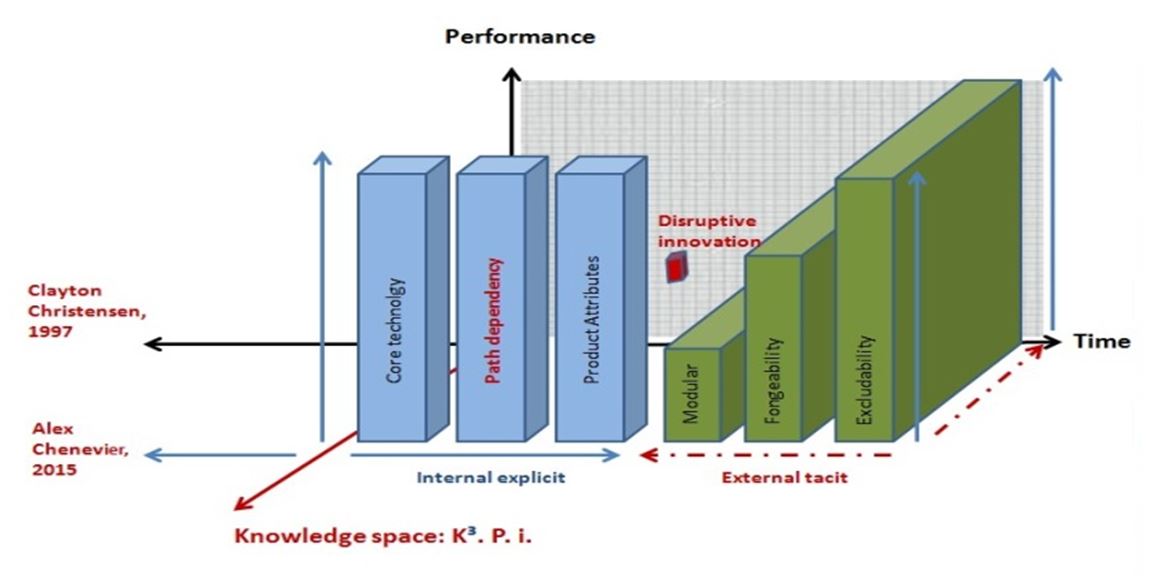

Parsed into the subject of innovation, the mere distinction is sustaining and disruptive innovation e.g. the private, with narrow applicability and the public i.e. asymmetric cognitive demand, calling for a sectional self absorption. Naturally, the strategic value of the firm’s resources and capabilities declines to the extent that they are substitutes, deteriorating in size, shape and efficiency. New knowledge is being scholastically determined by old knowledge. The aforementioned path dependency is the authentic codified knowledge platform for recombination.

To appropriate the asymmetric technological cognitive demand in a perfect market, it implies a specific disruptive innovation transformation or process (e.g. group or cubes of knowledge), scaling away on the name of modularity, fongeability and excludability (i.e. the tacit dimension of the knowledge space). Upon the non judgmental path dependency or platform of codified knowledge, the sociological science of knowledge provides the mechanical tools to apply a generation-recombinant mode opening ex poste and conditional distribution. The former applies the incentivized modularity bridging localized blocks of complexity, later broken down in smaller blocks leading to inescapable several or unique disruptive technological stories, opening social purpose compliance (i.e. true cultural authenticity of the firm).

Unified Model: Disruptive Innovation Methodology: K³ey Performance Indicator℠

The unified model is advocating the plurality nature of the board. Its appropriation offers an opportunity for Fortune 500 type companies long established legitimate authenticity in their respective industries, to mature disruptive models repetitively.

Disruptive innovation methodology is a cognitive distance computation of the external, tacit and public of know “what” stretched by the why, and the “how.” The combining factors offer the opportunity to seize the exploration, maybe for the first time as found definite, quantifiable, measurable and therefore applicable in business language with the scientific equation of K³ey Performance Indicator℠.

By the same token, the unified model is advocating the plurality nature of the board, opening at the same time tangible choice(s) and the ability to undertake or postpone in the name of tractability, fueled by further market consolidation (i.e. with a new paradigm of fertility vs. volatility, to-date of the consumer behavior i.e. managing identified time sequences of the cognitive distance.)

Its appropriation offers the opportunity for Fortune 500 type companies a long established legitimate authenticity in their respective industries, to mature disruptive models repetitively, opting out of “false” sustainability, albeit appearing compliant with established rules of risk management, repositioning the importance of sustaining innovation and inter industry endeavors.

About the author

Alex Chenevier, Founder of Managitech Ltd, based in Lyon and London, researcher/teacher & promoter of Innovation technology, digital applications, previously sales Director of web 1.0 startup based in Tokyo and Assistant to Vice-Presidents of financial practice at American operational consultancy in the City of London. Business Development Coordinator at Alexander Proudfoot, part of market-listed MCG (Management Consulting Group PLC).

Alex Chenevier, Founder of Managitech Ltd, based in Lyon and London, researcher/teacher & promoter of Innovation technology, digital applications, previously sales Director of web 1.0 startup based in Tokyo and Assistant to Vice-Presidents of financial practice at American operational consultancy in the City of London. Business Development Coordinator at Alexander Proudfoot, part of market-listed MCG (Management Consulting Group PLC).

In 2009, Alex successfully qualified for a Performance and Change Management Diploma with Open University in England. During the course of this master degree, the discipline of innovation and the specialty of disruptive innovation were identified for further development. These were to become the cornerstone of Managitech’s rapid growth.

References:

- Morris, L., The Innovation Master Plan, Innovation academy, the innovation Process, (2011), page 144.

- Birkinshaw J., Gisbon C., ’Building an Ambidextrous Organization’, Advanced Institute of management research, paper n°3, (June 2004), P 8.

- Sandström C., Disruptive and Discontinuous Innovation conference, Thesis “A revised perspective on Disruptive Innovation” Chalmers University of Technology, Göteborg, Sweden 2010.

- Suarez, F., F., Utterback, J., ‘Dominant design and the survival of firms’, Strategic Management Journal, Vo. 16, 145-430, 1995.

- Deloitte shift index survey

- Amable, B., Petit, P., ‘The diversity of Social System of Innovation and Production in 1990s’, University de Lille II, CEPREMAP, MODEM, CNRS-CEPREMAP, May 2001.

- Amit, R., Schoemaker, P. J. H., Strategic Management Journal, Vol. 14, 33-46, (1993), P33, 35).

- Sandu, A., Ponea, S., “Appreciative Socialization Group. A collaborative model”, Inventica, Performantica, (2010), P 2.

- Upon comparative examples extracted from Scott Berkun publication “The Myth of Innovation”, O’Reilly, August 2010).

- Jensen, M., B., Johnson, B., Lorenz, E., Lundvall, B-A, “Forms of knowledge and modes of innovation”. ScienceDirect, research policy 36 (2007), 680-693).

- Glassman, B., ‘Opportunity identifications‘, Polytechnic School of Engineering at New York University, Lecture Slides, Introduced February 2nd to the Innovation Juggernauts, 2013.

- P. Drucker, ‘From capitalism to knowledge society’ in D. Neef (ed.), The knowledge economy, (Woburn MA: Butterworth), 1998, P 15.

- M. Abramowitz and P. David, ‘Technological change and the rise of intangible investments: the Us economy’s growth path in the twentieth century’ in OECD, Employment and Growth in the knowledge-based economy (OECD,Paris), (1996), P 35.