By: Dominik Walcher / Fabrizio Salvador / Frank Piller

As NetNatives become consumers and buyers are “trained” by personalized offerings, the market is finally ripe for mass customization. In part two of this special series focusing on mass customization, Professors Frank Piller and Dominik Walcher take a closer look at what the current market has to offer and provide their conclusions after observing 500 leaders in the field from a customer perspective.

In a recent report for Forrester, J.P. Gownder concluded that “mass customization is finally the future of products“. One of the core reasons is that NetNatives are becoming shoppers. Consumers are finally ready for MC. We believe that it took ten years of consumer education on the net so that many of them feel confident to not just shop standard products from a catalog, but also co-create. Also, today’s 25-35ers – a core group of people buying custom goods – have been “trained” by personalized offerings of social networking, co-creation in computer games, and customizing their stream of music out of a big library of songs instead of relying on an album. This generation provides the natural shopper for custom goods – and is now getting old enough to have the discretionary income to buy custom goods online. Customization will be as natural as E-Commerce itself.

Customization will be as natural as E-Commerce itself.

But how does the future of products look today? In a recent study finalized in late 2011, we looked together with our colleagues Thorsten Harzer, Christoph Ihl and Fabrizio Salvador into the practice of mass customization toolkits. Our multi-stage study, “The Customization 500“, is the first global benchmarking study on mass customization and personalization in consumer e-commerce.

The Customization500 benchmark study

Given the scope of the mass customization market, we focused our analysis on companies that sell directly to end consumers (B2C), using an online toolkit for user co-design that is applied to change the physical characteristics of the product in a dedicated manufacturing step (hence excluding products where customization is embedded in the product like a smartphone). In addition, we pragmatically focused on companies which we were able to analyze as they had a website in either English or German language.

In total, we found more than 900 firms meeting these criteria (refer to configurator-database, a continuously updated list of mass customization companies). Following an extensive evaluation activity, we identified 500 companies that lead this field from a customer perspective (see http://bit.ly/mc500 for the full list). For each company, we gathered more than 100 data points. Data was collected by a group of trained expert evaluators who spent hours on each website. Also, each website was at least evaluated independently by three evaluators, and we took care to investigate all cases where the inter-rater reliability was not sufficient. The result of this exercise was a ranking of all companies, and allowed us to identify some of the leading offerings in the field. Figure 1 shows a summary picture of one of the companies included in the study. We will comment in Part 6 of this series of articles in larger detail on the evaluation criteria.

Figure 1: A typical illustration of the overall score sheet of a company included in the Customization 500.

Which are the dominating industries with mass customization offerings

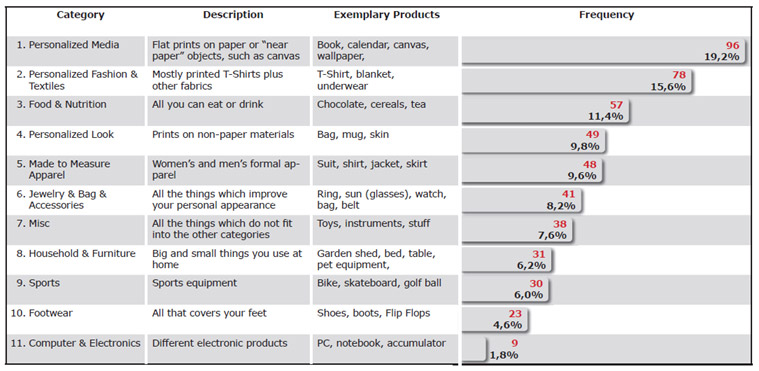

Figure 2 provides an overview of the categories where mass customization in B2C online today is employed. We find some very crowded categories that dominate the market. As expected, the option to personalize items by applying a user design on a basic product by different forms of digital printing is leading the field (categories 1, 2 and 4). There also always seems to be room for another custom shirt business or personalized sticker / foil to decorate your smart phone. Interestingly, however, there also is a very large (and still growing) field of applications in the food and nutrition industry where mass customization is applied to customize taste and nutrition of food.

Figure 2: Categories of mass customization application in the Customization500

Using customized products for the gift market is a growing, but still not over-crowded opportunity. Most vendors still see mass customization as a one-to-one business, providing a custom product for the buyer (hence, also the dominance of me, my, mein etc. brand names). However, some of the most successful mass customizers have realized that mass customization offers a perfect cure of a common problem: “Oh my good, [Name here]‘s birthday is coming up in a few days — I need to rush to get an “original” present now – but what?” Take customized chocolate. Chocri and MyM&Ms, for example, are competing with gift cards and gift books, not with other candy items. They are not to be eaten – even if they taste very good – but to express that I have thought of you and really have spent some effort in getting this present done. For this, I am willing to pay a premium of 1,000 percent or more. As a provider, however, this means that a delivery time of 24 hours is a must, plus advice for easy gifting, wrapping, additional greeting cards etc. Here, we still see many untapped opportunities.

…we interestingly only found very few good configuration toolkits (for functional customization) in the field of consumer electronics and computers.

When looking further in the domains of mass customization application, we interestingly only found very few good configuration toolkits (for functional customization) in the field of consumer electronics and computers. Here, apparently the improvements of hardware apparently make it less useful to customize a product via toolkits before purchase, but allow users to customize the product during the usage stage with an embedded toolkit. It may be a sign of the shift in mass customization that the early pioneer, Dell, today almost offers no customization at all at its website. Well, there still is a configurator, but the choice options are very limited.

A closer look into company structures

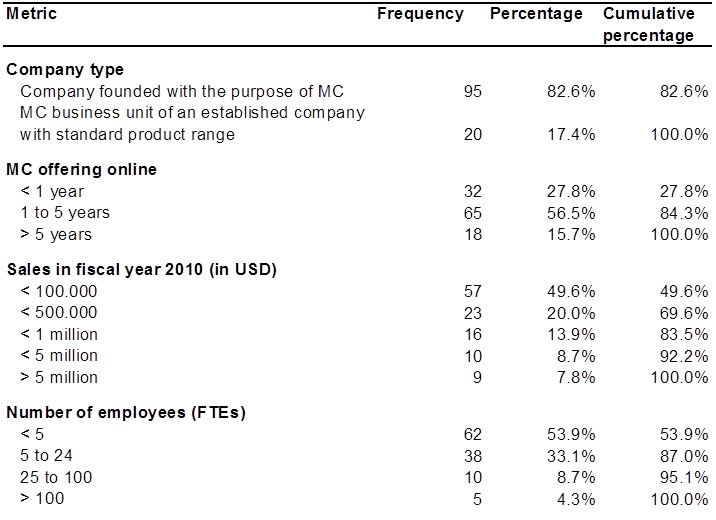

For 120 of the 500 companies, we also could obtain extensive data by means of a company survey. Descriptive statistics for the responding firms are given in Figure 3 providing an enhanced insight into the company structures of the players in the mass customization market today.

About 83% of the firms were founded exclusively with the purpose of mass customization, while 17% run their mass customization business in addition to their standard business. In general, most firms are rather young.

…the current dynamism in mass customization is driven primarily by innovative startups…

Only 16% of the mass customization offerings are older than five years, indicating the long time lag from the description of the idea to the broader application of toolkits for co-design. Annual sales of the responding firms range from less than $100,000 to over $5 million in the last fiscal year, with the majority having sales of less than $1 million (83.5%). 54% of the firms have less than five employees. This is consistent with our observation that the current dynamism in mass customization is driven primarily by innovative startups that have built their business models from the ground up and focus entirely on the promises of mass customization.

Figure 3: Descriptive data from the company survey of responding firms

Clones dominate mass customization entrepreneurship

As a pioneer, be fast, smart, and differentiate your business beyond the brand name and your core products.

If you have a good idea for a custom product, it will be copied fast. This is one of the major conclusions we can draw from our observations of the market. The barrier to entry for many products is rather low, and once an interesting idea comes on the market, copycats follow quickly. This in general has not to be a bad thing, as also clones help to build the market, generate attention, and signal to press that this is a new category. However, for the pioneers this means that they have to focus as much attention on branding and differentiating their business as upon building the processes and systems. Patents or other forms of IP do not provide much help here, thus, we conclude: As a pioneer, be fast, smart, and differentiate your business beyond the brand name and your core products.

Despite the many “me-too” offerings, surprisingly often the late followers are doing very well in their segments. We see three reasons here:

(1) Strong growth opportunities in every market: The late comers even in the most crowded categories (like custom men’s shirts) enter into a market that still is not matured at all. Overall, there is not one category in consumer B2C where custom products have more than a few percent of the overall category (in most cases, they have a few tenth of a percent!). So there is still enough space for everyone.

(2) Market education: Pioneers in a category often have to spend a lot of attention to educate the market and just let consumers (and journalists) know that this kind of custom product is available. Latecomers can build on this generated market education.

(3) “Best of Breed” solutions: Latecomers often perform as best of class of established players, combining the design elements of pioneers, but also of mass customization sites in other categories. A recent good example if getwear.com, which came late with another custom jeans offering, but has the best online configurator in its industry.

Mass customization platforms make the third wave of mass customization

But despite many clones, we also found a lot of innovative business models. Some of the best performing companies in mass customization are not stand-alone businesses that deal directly with consumers, but are mass customization platforms. These platforms can be regarded as the third stage of mass customization development.

The first wave of mass customization was driven by the early pioneers in the field in the early 1990s, motivated by the opportunities of new flexible manufacturing technology. Levi Strauss is a typical example from this time. Most of these offerings worked offline in a traditional retail environment. Also, first internet offerings coming of in 1995 and 1996, like CyberChocy or Creo Interactive, came up at this time. But in most markets, consumers were not ready yet.

The second wave came with the internet economy, around 1998-2002. Often, startups at that time just opened, as everybody could do it, not as customers needed it. But some great examples of mass customization survived, like NikeID (opening only because former Nike CEO Phil Knight wanted to have „something in the internet“, and so they selected mass customization as this promised to cause little channel conflicts with established retailers). In the following years, the internet-based mass customization offerings matured, and many more followed. It was the broader development of online configurators that made mass customization happening in a larger scale.

But a third wave of mass customization is happening now: It is driven by companies like Ponoko, Zazzle, Spreadshirt, Cafepress, Lulu, Gemvara, and many others, which offer design, manufacturing, and retail capacity to everyone. These platforms allow entrepreneurs to open a dedicated mass customization business at very low investment cost. On these platforms, people are not just customizing to fulfill their own needs, but to create (micro) niche markets for their peers. The platform providers have successfully combined the eBay idea of very easily selling things over the internet with the customization model of robust fulfillment processes. Here, we are just at the beginning and will see many more applications soon.

By Frank Piller & Dominik Walcher

About the authors

Frank Piller is a chair professor of management and the director of the Technology & Innovation Management Group at RWTH Aachen University. He also is a founding faculty member and the co-director of the MIT Smart Customization Group at the Massachusetts Institute of Technology, USA. Frequently quoted in The New York Times, The Economist, and Business Week, amongst others, Frank is regarded as one of the leading experts on mass customization, personalization, and open innovation. Frank’s recent research focuses on innovation interfaces: How can organizations increase innovation success by designing and managing better interfaces within their organization and with external actors.

Frank Piller is a chair professor of management and the director of the Technology & Innovation Management Group at RWTH Aachen University. He also is a founding faculty member and the co-director of the MIT Smart Customization Group at the Massachusetts Institute of Technology, USA. Frequently quoted in The New York Times, The Economist, and Business Week, amongst others, Frank is regarded as one of the leading experts on mass customization, personalization, and open innovation. Frank’s recent research focuses on innovation interfaces: How can organizations increase innovation success by designing and managing better interfaces within their organization and with external actors.

Email: piller@mass-customization.de

mass-customization.blogs.com

Dominik Walcher is professor for marketing and innovation management at Salzburg University of Applied Sciences / School for Design and Product Management. He studied architecture and management at the University of Stuttgart, the Technical University Munich (TUM), and the University of California at Berkeley. His doctoral thesis about mass customization and ideation contests was awarded with several prizes. In the last years, he has extended his field of research to brand management, business creation and sustainability marketing. He was a co-founder of a startup company in the field of customizable and eco-intelligent products.

Dominik Walcher is professor for marketing and innovation management at Salzburg University of Applied Sciences / School for Design and Product Management. He studied architecture and management at the University of Stuttgart, the Technical University Munich (TUM), and the University of California at Berkeley. His doctoral thesis about mass customization and ideation contests was awarded with several prizes. In the last years, he has extended his field of research to brand management, business creation and sustainability marketing. He was a co-founder of a startup company in the field of customizable and eco-intelligent products.

Email: walcher@mc-500.com

www.mc-500.com

Upcoming articles in this series:

Introduction: A special series of articles on mass customization and customer co-design

Part 1: Competing in the Age of Mass Customization

→ Part 2: The market for mass customization today

Part 3: Solution Space Development: Understanding where customers are different

Part 4: Robust Process Design: Fulfilling individual customer needs without compromising performance

Part 5: Choice Navigation: Turning burden of choice into an experience

Part 6: Choice Navigation in Reality: A closer look into the Customization500

Part 7: Overcoming the Challenges of Implementing Mass Customization

Part 8: A Balanced View: Conclusions and Key Learnings