By: Frank Piller / Kathleen Diener

Successful open innovation relies on intermediaries and platforms connecting an organization with outside solution providers, so called open innovation accelerators (OIAs). With more than 180 players, the market for OIAs however is getting complex and difficult to navigate. A recent study by RWTH Aachen compared these OIA market. In this report, we summarize some of the main findings.

Open innovation (OI) has developed from a buzzword into an established practice of innovation management. Sources of external input for innovation are plentiful, including market actors like customers, suppliers, competitors; the scientific system of university labs and research institutions; public authorities like patent agents and public funding agencies; and mediating parties like technology consultants, media, and conference organizers.

Characterizing for OI is the integration of often “unobvious” actors (from different domains, industries, or different stages of the value chain) in a flexible and informal way beyond the traditional notion of innovation networks or contract research. New forms of organizing distributed problem solving like crowdsourcing have become a leitmotif for many innovation departments.

A new industry of service providers for open innovation has emerged as part of a central open innovation infrastructure.

But when engaging in OI, organizations face the need of creating an internal ecosystem that allows them to profit from external input in an efficient and effective way. This demands two capabilities:

- Firstly, companies have to know which tools exist to tap into external knowledge stocks for innovation in a flexible way. They have to gain knowledge how to operate these approaches and learn about their success factors.

- Secondly, companies have to identify and reach out to potential external partners which can help them in for their open innovation process. They require an overview of methods and possible partners who are specialized in applying these methods.

Open Innovation Accelerators

In the last decade, a new industry of service providers for open innovation has emerged supporting companies in executing these tasks. We call them Open Innovation Accelerators (OIA), intermediaries, consultancies, and agencies helping their clients to accelerate an open innovation project by providing dedicated tools, methods, access to an established community of solvers or participants, but also education and process consulting. With more than 180 players, the market for OIAs however is getting complex and difficult to navigate.

Image 1

Market Study& Data

Here, our research on this “The Market for Open Innovation” wants to help. In the last months, we engaged in an intense process of analyzing providers of open innovation services. Note that our focus is on “inbound open innovation”, i.e. the absorption of external input and knowledge for an organization’s innovation process. There also is “outbound open innovation”, i.e. the transfer and commercialization of internally developed technologies at an external market place. While some of the OIAs covered in our study also engage in outbound innovation, our analysis is based on inbound open innovation.

For our research, we invited 160 intermediaries to join a 90 min online survey investigating the OIA’s business model and environment, productivity, services offered, project specifics, and characteristics of their participant pool. In addition, we asked about estimates for the development of the open innovation market. About 40 percent of the OIAs contacted provided us with a complete data set. For the remaining companies, we used secondary data sources.

In total, our study is the largest inquiry of the global market of open innovation services, finally providing insights into more than 180 OIAs.

The market of support services and consulting for open innovation currently is €2.7 billion, and will double until 2015 to €5.5 billion

Structure of the OIA Market

We find that the market for open innovation is getting mature. On average, OIAs have already conducted a high number of client projects, many of them 200 and more. The broad distribution of open innovation projects over various industry sectors also demonstrates that this approach cannot be limited to certain branches or sectors. The market in general demonstrates a strong demand for open innovation services.

The market for OIAs shows continuous growth. A self-assessment by the OIAs in our study reveals an estimate of the recent market volume of €2.7 billion. OIAs expect that this volume will double within the next two years (until 2015) to €5.5 billion. Ideation contests are seen as the most promising open innovation format. They cover almost 80 percent of the entire open innovation market.

Image 2

We find that OIAs more and more also reach out to functions and tasks beyond new product and service development. We find new fields of application like marketing, customer service, recruitment, knowledge management, and HR. The core idea pattern of open innovation to engage an open, undefined network of people in form of an open call or open search activity seems to be transferrable to a variety of tasks.

When comparing our 2013 data with data from an earlier study in 2010, we find that about 20 percent of the 2010 OIAs do not exist any longer or have been acquired by other players. We expect an even stronger wave of acquisitions and mergers for the coming years.

The average cost for an OI project with an OIA is €43,000. But project costs differ widely, ranging from €12 (for a basic monthly description of an OIA web-service) to €164,000 EUR (for an OI consulting service). The main project cost driver is personnel capacity. In the end, OIAs are no IT services or “self-service internet platforms”, but knowledge-intensive service businesses. Recruiting experienced project managers and analysts becomes a major challenge for many OIAs.

OIA Services and Methods

We find that OIAs can be clearly distinguished into two groups:

- A first group runs an open innovation project on behalf of their clients and provides a solution to a given task.

- The second group helps their clients in building own open innovation competences to engage in direct collaboration with external entities. The latter has a stronger focus on educational aspects.

In general, OIAs differ, first of all, regarding their approaches how to tap into an external knowledge space. These approaches can be differentiated according to the way how contributors for a specific project are selected and the collaborative process is being initiated. We find three options:

- Open Call: Calling for individuals to identify themselves by contributing to a given task;

- Open Search: Searching for relevant information or individuals according to a given task

- Selective Open Call: Calling for individuals, but within a pre-defined set of potential participants (a hybrid between the previous two options)

These three options also help to structure the service types that OIAs offer when we add the type of information requested by the client: information about market needs or information about technical solutions. Our survey revealed that idea or solution contests, based on an open call, are the dominant service offered by OIAs today. But 60 percent of all OIAs offer at least two different services.

Table 1

Three Questions to Consider When Selecting an OIA

From a client perspective, a number of key characteristics should be considered when picking the right OIA:

(1) What is the expected outcome? First of all, consider the type of task and the nature of your innovation problem. Not all OIAs are suited for every open innovation challenge (even if some advertise so!!). OIAs differ with regard to the breadth, scope, and structure of their pool of potential participants, and the options for clients to control access to this pool and the interaction within a given project.

Image 3

Always remember that open innovation means mass collaboration.

Clients always have to remember that open innovation means mass collaboration. It is a highly interactive process where an undefined number of individuals is communicating intensively and engages in cooperation and exchange. External actors are often integrated from the start to the end of a project.

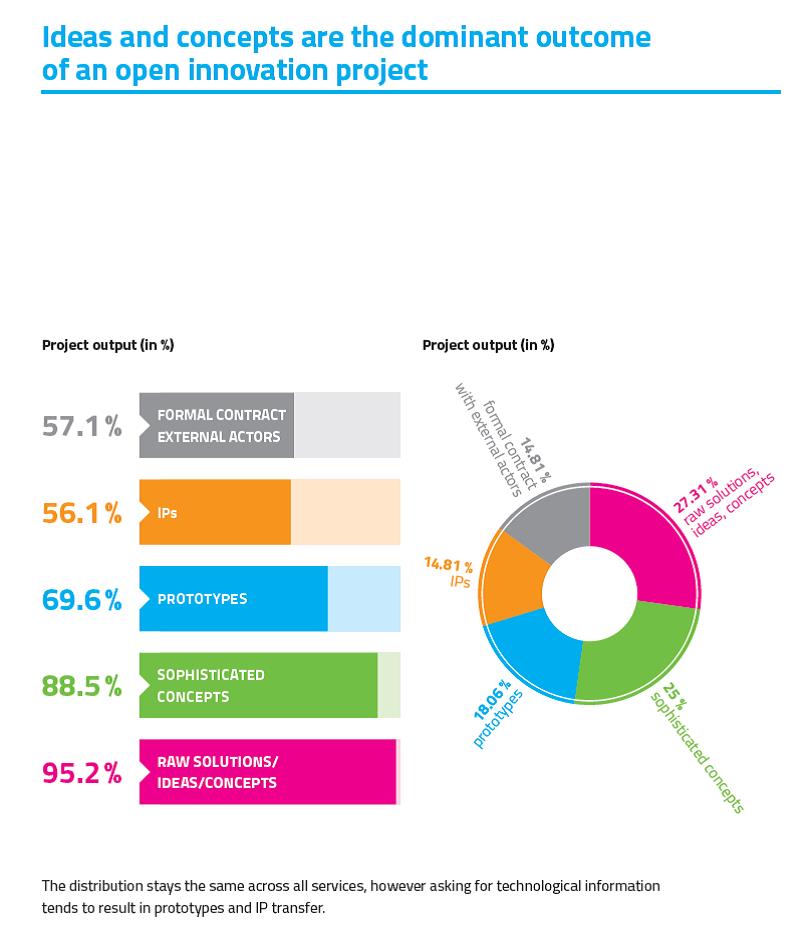

Clients thus have to engage in monitoring the interaction among the entire project, which can in generally be structured along three stages: ideation, concept generation, and launch. OIAs can deliver input for each phase – form from ideas to IP. Outcomes of an OIA project range from raw ideas to sophisticated concepts – and selecting an OIA very much depends on the preferred degree of outsourcing the OI function (and control) to the OIA.

(2) What is the software platform? Software plays an essential part of any open innovation venture. Web 2.0 and social software technologies allow OIAs to operate globally and integrate large numbers of participants without high transaction cost. In 90 percent of all cases, OIAs offer a distinct software solution. Hence, selecting an OIA also means deciding whether the software solution should be implemented in-house (following a traditional license model) or using it as a web-service or via a hosted service of the OIA.

(3) What are the characteristics of the OIA’s community? OIAs build on the involvement of a community (in the broader understanding of the term). OIAs connect clients through their communities with a variety of external actors, most of them are new and unknown to the client (this “looking out of the box” is exactly the value of open innovation).

Image 4

Typical Community Structures of OI Projects

OIA services differ significantly regarding their community composition. There is a general focus on applied sciences. Yet expertise background is influenced by project targets. Services like technical search involve individuals with expertise preferable in natural and applied sciences and less in social sciences or arts. On the contrary community members for contests, e.g., design contests, or market search are characterized by experience in the field of arts or social sciences. Similar to the characteristic by background of expertise is the characteristic by the level of expertise. Problem solving projects demand a higher expert level than projects focusing on consumer insights.

In average, we find that OIAs have an existing pool of participants (their “community”) of 20,000 members. But OIAs specializing on ideation or technical contests often have communities of more than 100,000 members. To join the pool of participants, prospective participants have to accept general terms and conditions, but in general do sign not a formal contract. This is a core difference of open innovation via OIAs compared to traditional forms of R&D networks or alliances.

Between communities, the general level of expertise of its members differs significantly among the different services. OIAs offering technical search services in form of technology scouting, for example, have access to high level expert communities, while OIAs focusing on ideation and concept generation often have a broad, very heterogeneous community of “average” consumers. From this pool, about 200 members finally join a particular project (in the case of contests, this number is 300). About a third of the OIAs offer their clients the opportunity to select participants matching socio- demographic criteria.

Open Innovation Accelerators (OIA), who are becoming an important part of the infrastructure for open innovation today

Conclusions

Open innovation is there to stay. And so are Open Innovation Accelerators (OIA), who are becoming an important part of the infrastructure for open innovation today. OIAs are intermediaries, consultancies, and agencies helping their clients to accelerate an open innovation project by providing dedicated tools, methods, access to an established community of solvers or participants, but also offer education and process consulting. Hence, managers have to get a better knowledge of the market for open innovation support. Our study of the market of OIAs finds that these companies differ significantly and have very specific foci where they really can provide most value.

For a full insight into the market for open innovation, refer to The Market for Open Innovation: The 2013 RWTH Open Innovation Accelerator Survey. authored by Kathleen Diener and Frank Piller, 2nd edition, May 2013. Lulu Publishing: Raleigh, USA.

Image 5

About the Authors

Frank T. Piller is a professor of management and the director of the Technology & Innovation Management Group of RWTH Aachen University, Germany, where he directs one of Europe’s largest research initiatives on open innovation and co-creation.

Frank’s general research interests are organizational structures, processes, and leadership for innovation and change.

Kathleen Diener is a research associate at the RWTH TIM Group since June 2007. She holds a Master in Psychology of Humboldt University Berlin.

Her research focuses on intermediaries operating in the field of open innovation, the phenomenon of not-invented-here, and models to explain the (optimal) degree of openness in an innovation project.

Photo: Several metal balls or spheres linked by arrows from shutterstock.com