By: Anders Johannson / Björn Axling / Johan Geterud / Nils Bohlin / Tim Conze

The share of profits from new products is particularly high in medtech compared to other industries; and Arthur D. Little’s recent global Innovation Excellence study demonstrates that a high performance innovation system generates significant and quantifiable effects on profitability and accelerated time to market for new product development. This viewpoint outlines the future of the medtech industry and its opportunities as well as how to address the challenges through implementation of a well-designed Innovation Management System.

The global medtech industry is maturing and consolidating while serving an increasingly demanding healthcare sector

The medtech industry is a global USD 325 billion high-tech industry. Its historical annual growth of 7% over the past five years was fueled by greater utilization of technology within medical practice and related increases in healthcare spending. However, the industry is poised for slower growth, forecast at 4% annually during the next five years. Over past decades several large players have implemented M&A campaigns to combat sluggish organic growth in order to achieve growth targets. This consolidation is expected to continue, with the top 10 players already commanding more than 50% of the market.

This continued industry restructuring – as well as ongoing strategic product development – creates players with portfolios that extend across large parts of the medtech spectrum, both in terms of products and buyers. Medtech products and services are utilized by hospitals, outpatient clinics, home care, and healthy individuals who wish to prevent disease.

Healthcare providers are under pressure to deliver improved medical outcomes while consuming fewer resources.

Healthcare providers are under pressure to deliver improved medical outcomes while consuming fewer resources. As large groups reach healthcare-intensive old age, the demand for healthcare is growing accordingly, both in developed and emerging markets. At the same time formerly terminal illnesses and diseases have become treatable, further increasing the burden on healthcare systems. Unfortunately the majority of countries fail to educate enough qualified healthcare professionals to replace retiring generations and to account for this increased healthcare demand.

Following the economic crisis, budget pressures in developed nations and general hesitation to raise taxes and/or increase deficits has prohibited the expansion of budgets to serve the demand for healthcare. This has forced healthcare providers and payers to become increasingly proficient buyers and to use pricing systems and reimbursement rules to control spending.

Healthcare policy makers and practitioners have begun to embrace these realities and are encouraging development of solutions that provide the same healthcare with fewer qualified personnel and at a lower cost, e.g. by increased treatment at home. How quickly the home care trend is adopted depends on cultural and infrastructural factors in each market. This shift of healthcare from acute hospitals to a home setting requires adapted medtech solutions, e.g. with respect to ease of use. Within hospitals, the healthcare sector is increasingly looking to buy integrated solutions and complete offerings with a clear value proposition of improved patient flows, lower personnel requirements and increased resource productivity.

Health, economic and outcome analyses are common strategies to limit growth of healthcare budgets in established markets. Payers no longer automatically reimburse products that improve therapies at a higher cost. Healthcare systems in emerging markets frequently lack the evidence base, qualified personnel and/or budgets to simply adopt products developed for established markets. Any medtech growth in these markets will be dependent on adapted products.

Such developments in established healthcare systems and the sometimes radically different healthcare resources in emerging markets will require a new mode of innovation to stimulate future growth in medtech companies.

Six medtech innovation imperatives to cope with the future industry landscape

Arthur D. Little’s recent Global Innovation Excellence study, in conjunction with our long history and successful track-record of working closely with leading medtech players, has revealed six innovation imperatives which are critical to address current and future industry challenges and take advantage of the opportunities associated with these medtech sectoral dislocations – these imperatives demand a high performing innovation system well beyond product innovation:

- Cost-efficient products tailored to local needs, with improved medical outcomes

- Complete solution offerings covering entire healthcare work flows

- System integration & connectivity

- Efficient leverage of clinical data

- Ease of use and fit with customer ways of working with high patient safety

- Manage regulatory complexity (e.g. trend from an ex-post approval to an ex-ante approval similar to pharmaceutical marketing approval).

Cost-efficient products

Innovation must generate cost-efficient products, tailored to local needs and with improved medical outcomes, to achieve growth in developed markets and to capture market share in emerging countries. It is not enough to simply duplicate what is already being sold, both due to cost, resource and competence reasons in these diverse market segments. The medtech industry is therefore pushed to create innovation systems that work globally and are agile in adapting innovation solutions to local needs. Cost-efficient tailored offerings require the ability to manage the product and the product data over the lifecycle (PLM), i.e. re-using design, global sharing of development efforts and early collaboration with selected suppliers through sharing of product data. Cost efficiency is and will remain a key selling proposition particularly in the low tech categories of the medtech industry, where some companies simply must succeed to make a living in a commodity market.

Complete solution offerings

Given limited budgets and cost containment of payers, the medtech industry’s innovation focus needs to also include service, process and business model innovations to avoid “commoditization” of the offerings and to receive adequate payment for innovative product solutions. This trend places the traditional revenue model of selling a product at a fixed price under pressure in favor of other approaches, e.g. complete offerings/solutions covering entire healthcare work flows and “pay for performance”. Medtech players are collaborating more with healthcare providers and are increasingly becoming partners to their clients and less traditional product providers. Concepts such as managed equipment services are becoming more common and medtech players should continue to strive in this direction as there is still untapped potential in this area.

One parallel trend in how medtech companies go-to-market is the increased importance of addressing end customers directly, both through products but also services e.g. health management and health education. Some segments have successfully created health insurance payment structures that provide a flat fee for a basic product, but allow customers to upgrade to a high end solution. In the hearing aid industry this is the preferred model in many markets. Given a clear unique selling point that triggers desire and high emotional involvement of customers, this helps medtech companies to overcome budget limitations and generate value for their R&D and product innovation investments.

System integration & connectivity and leverage of clinical data

The push towards complete solutions goes hand in hand with an increasing demand for integration of different types of equipment as well as between hardware and software. The innovation system must be focused on bringing integrated solutions with increased connectivity to e.g. allow remote patient treatment at home. The integration of hardware and software is also increasing customer demands on the collection, storing and utilization of clinical data generated through the use of medtech products and services. The ability to leverage clinical data requires even greater and more focused innovation efforts in the near future.

Ease of use and managing regulatory complexity

Lastly, to be successful in the increasingly demanding medtech industry, emphasis must also be placed on product ease of use to ensure patient safety and compliance as treatment is being delivered by healthcare personnel with varying educational levels and at remote/home settings. Patient safety will be a top priority in the future and our Innovation Excellence study reveals that companies expect that managing the increasingly demanding regulatory requirements will require more disciplined innovation initiatives. This also puts extra pressure on medtech companies to apply good PLM practices. Good PLM practices are not only supporting product cost optimization, but also enabling innovation at a lower level of regulatory risk.

Decoding innovation success

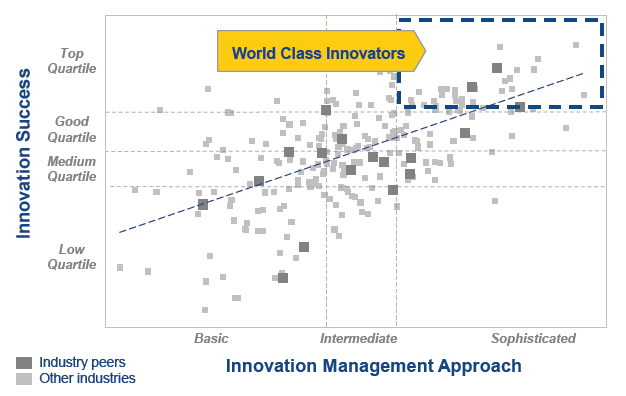

There is strong evidence that excellence in innovation management based on Arthur D. Little’s model leads to higher innovation success. Companies that holistically address innovation management activities in a sophisticated way achieve tangible financial and competitive advantages.

Figure 1 – Arthur D. Little’s Innovation Excellence Model

Although some companies manage to yield good results with less sophisticated approaches (natural innovators), the evidence of the positive impact from a structured innovation management approach is clear: there is not one single company that actively pursues performance improvements in Arthur D. Little’s Innovation Excellence Model that scores poorly in the Innovation Success index.

Figure 2 – Plot of full Innovation Excellence survey scores

The value of improving innovation performance in medtech is higher than in other industries

Arthur D. Little’s Global Innovation Excellence study reveals that by comparing medtech top innovators to average performers, the share of revenues derived from newly launched products are up to 20% times higher, both for newly launched products over the course of last year as well as in the last three years. With regards to profitability, the innovation impact is even higher as top innovators have up to twice as much share of EBIT from new products.

Top innovators generate as much as 30% of company revenue and EBIT from innovations launched in the market in the last three years. In other words, the focused work to drive competitive advantages through innovation pays off and even more so in the medtech industry where top innovators enjoy particularly high measurable results.

The road map to improving the performance in the Innovation Management System

Each company’s journey towards innovation excellence needs to be based on their own prerequisites. When defining the roadmap towards innovation excellence there are common characteristics from successful companies to learn from. Three key aspects to move towards innovation excellence have been identified:

-

Executive commitment

The first and most important issue is to place innovation excellence on the executive agenda, not only as a vision statement, but as a tangible strategic focus to which the organization is held accountable. With historical aggressive growth through M&A and a maturing industry consolidation, companies are now forced to take a much more active role in fuelling their organic growth through innovation. The focus needs to be firmly rooted all the way from top management down through the organization to enable fast, strategically aligned, yet well-informed and empowered decisions to drive competitive advantages and ultimately, the growth of the company.

-

Balance up- & downstream innovation

All companies need to create a balance between their upstream and downstream innovation activities. Far too many companies realize that their innovation output (i.e. new products) do not perform as expected and make the conclusion that the problem is in R&D (downstream). Arthur D. Little has often demonstrated that the root causes tend to be found more in a poor strategic portfolio planning (upstream) and lack of cross-functional alignment before any development activities are initiated. Establishing full cross-functional participation throughout the entire innovation system is a key characteristic of successful innovators.

-

Match process guidance & creative culture

To deliver potentially groundbreaking innovations there needs to be a balance between top-down guidance, often resulting in a strict process mindset, and the bottom-up culture of creativity and out-of-the-box thinking. At the end of the day, innovation is about venturing into the unknown and developing new solutions that solve customers’ problems in a better way than the competitors, requiring a certain level of risk acceptance. Too rigid top-down processes and risk aversion may stifle creativity and drive incremental innovations that cannot be expected to result in distinct competitive advantages. Furthermore, processes need to be designed as a support that minimizes internal bureaucracy.

The race is on to claim the innovation leadership position in medtech

Although medtech top innovators (scoring in the top industry quartile) already perform better than their average industry peers, the industry shows a diverse picture in terms of performance. The best innovators are actively engaging in pushing forward in a number of innovation areas, yet very few “world class innovators” have been identified.

Figure 3 – Medtech industry innovation excellence score

In fact, there is still available space in the “true” top innovator quadrant of Arthur D. Little’s innovation matrix. This leads to three main conclusions:

- The current few medtech “world class innovators” are reaping first mover advantages by creating differentiating value and competitive advantages driven by innovation

- Other companies that have started to implement sophisticated innovation management have not yet been able to fully capitalize on their efforts

- The lag in getting measurable value is both related to lead time in organizational change and market inertia to accept new solutions. Just as important however is insufficient attention to the necessary cultural change when trying to implement new ways of working.

Applying the power of innovation will be imperative to becoming a winner in the future landscape of medtech and the race is on to claim the innovation leadership top spot!

About the authors

Anders Johansson Is a Partner at Arthur D. Little’s Gothenburg office and leads the Global Technology Innovation Management Practice.

Anders Johansson Is a Partner at Arthur D. Little’s Gothenburg office and leads the Global Technology Innovation Management Practice.

Björn Axling Is a Manager at Arthur D. Little’s Gothenburg office and member of the Technology Innovation Management Practice.

Björn Axling Is a Manager at Arthur D. Little’s Gothenburg office and member of the Technology Innovation Management Practice.

Johan Geterud Is a Manager at Arthur D. Little’s Stockholm office and member of the Strategy & Organization Practice.

Johan Geterud Is a Manager at Arthur D. Little’s Stockholm office and member of the Strategy & Organization Practice.

Nils Bohlin Is a Partner at Arthur D. Little’s Stockholm office and leads the Global Healthcare Practice.

Nils Bohlin Is a Partner at Arthur D. Little’s Stockholm office and leads the Global Healthcare Practice.

Tim Conze Is a Consultant at Arthur D. Little’s Stockholm office and member of the Healthcare Practice.

Tim Conze Is a Consultant at Arthur D. Little’s Stockholm office and member of the Healthcare Practice.

Photo: Chemical laboratory scene from shutterstock.com