By: Rick Eagar

Looking back is a natural as we look to learn lessons from past activity. But perhaps more interesting is to look forwards. In this article Rick Eagar draws on the results from recent research that surveyed the opinions of global Chief Technology Officers and Chief Information Officers and identifies key changes in five distinct but interrelated innovation management concepts as being important for the years ahead.

By helping clients to develop new approaches and tools for improving innovation management we have a good overview of the current picture. But what can we expect over the next ten years? What key trends do we see in the way companies are managing innovation? What approaches and concepts are going to be ground-breaking, and what will this mean for business leaders?

We see that the increasing need for innovation is driven by external factors such as ongoing globalization, the shift of economic gravity away from traditional Western countries, continuing economic uncertainty and changing and more individualized customer demands.

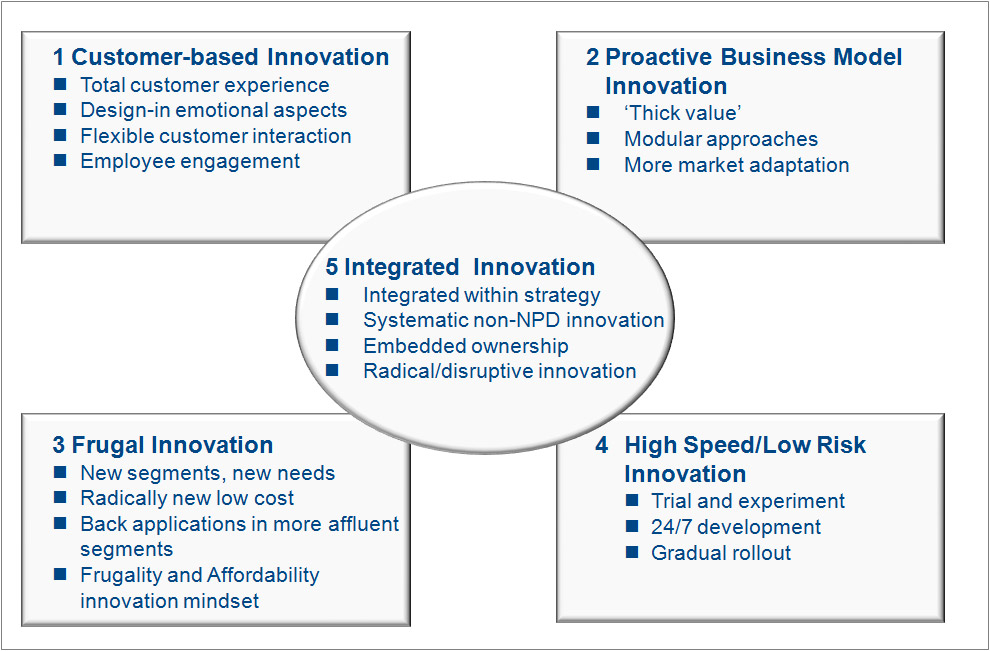

From recent research that surveyed the opinions of global Chief Technology Officers and Chief Information Officers, we identified key changes in five distinct but interrelated innovation management concepts as being important for the years ahead: customer-based innovation, proactive business model innovation, frugal innovation, high-speed/low risk innovation and integrated innovation. But what do we mean by these?

Table 1: Five innovation management concepts to watch

1. Customer-based innovation

‘Customer-based innovation’ is about finding new and more profound ways to engage with customers and develop deeper relationships with them. In our survey, CTO/CIO’s rated this as the most important concept of all in terms of investment priority for the coming years. Customer-based innovation is driven strongly by the convergence of three key trends:

Total customer experience

Driven by a desire to build a deeper relationship with the customer, what used to be a business model for B2B businesses with only a limited customer base is quickly developing within other spheres. Japanese and German vehicle manufacturers (for example Lexus, Infiniti and BMW) continue to explore ways of designing an ‘ownership experience’ rather than just a car, designing service and support at all touch points with the same care as they design the cars. Such skills will serve them well as we move towards electric cars and need to manage customer acceptance issues around batteries and their replacement.

Design-in emotional aspects

The second trend emerging in this space is the realization that, as technology allows manufacturers to deliver as much and often more functionality than the typical consumer can use, the bases of competition will change. Rather than compete on yet more features and functions we will see manufacturers compete even more on style, design and emotional connection, with approaches used in the luxury and fashion markets being increasingly adopted in more traditional sectors.

Social networking

The third converging trend is closely linked – the use of social networks to underpin companies’ propositions and relationships with their customers. Increasingly this will span B2B as well as B2C: for example in recent work for a financial institution we explored how they might develop tools to allow banks to build relationships and communities within and between the finance directors of large corporates.

So what does this mean for companies?

First, companies will need to be more flexible and creative in defining the way they interact with customers. As the battle for relationships continues, we expect to see a blurring and shifting of sector boundaries – we have already seen this happen as computing, mobile devices and software have arrived at the smartphone and the app. Who owns the relationship and what will be the determinants of the market? Similarly, we see utilities battle with insurance companies for ‘ownership of the home’ as they both offer portfolios of services in the land grab for a deep relationship with the homeowner. We will see social networking tools increasingly used, as the bases of competition move from price and service offering to relationship and customization.

“Customer-based innovation is a good thing if it is based on developing insights about what the customers need. This is not necessarily what the customers say they want. Customers rarely come up with big breakthrough ideas of, say, an iPad-like nature.”

– Professor Tom Sommerlatte

Second, companies will need to become more sophisticated in their open innovation approaches. We will, of course, continue to see companies seeking ideas and partnering with customers, partners and suppliers. But we will also see the focus shift from innovation from any source and away from the blind belief in “the wisdom of the crowd”, towards targeted open innovation aligned with strategy driven by community and by a desire to build relationships and loyalty.

The interface between customer and supplier will blur and we will see ever-more complex alliances. This is already visible in the domain of commercial aerospace operations with its network of manufacturers, service suppliers, maintainers and supply chains, many of which compete in one place and partner in another. In future decades we will look back and realise that we are today with open innovation where we were with new product development and stage-gate processes in the late 1980s.

Third, in a relationship-dominated world, companies will need to focus more on the role of employee engagement in innovation. As companies operate in new environments and as they design all their touchpoints to support closer engagement with the customer, so the role of the employee becomes key to delivery. While many companies are pursuing employee engagement, few have so far linked this explicitly with their innovation agenda.

The winners will be those who are able to link strategy, innovation, product, customer experience and employee engagement, all in a landscape of shifting sectoral boundaries and new bases of competition.

2. proactive business model innovation

A business model defines how to create and capture value within a value chain, considering both operations and strategy. Business model innovation as a concept is certainly nothing new, but there is still much to be done to develop a convincing innovation management approach that is sufficiently systematic and repeatable to generate new, innovative business models.

We expect to see three key trends in successful business model innovation in the future.

“Companies’ approaches to defining value have been too narrow. Companies need to think about how to partner in new ways with others to create and capture more value.”

– Professor Joe Tidd

Deliver “thick value”: First and foremost, consumers and stakeholders will require companies to target more the creation of “thick value”. Today business still often focuses on the creation of “thin value”, i.e. purely profit-driven transactions between the organization and its stakeholders, as opposed to “thick value” which considers more lasting stakeholder value, for example increasing the resilience of stakeholders in the face of global societal and economic pressures such as climate change, demographics or energy security. As part of the business model innovation process, organizations will need to identify new types of thick value – purpose-driven stakeholder transactions – to fill unarticulated needs both meaningfully and profitably.

A good example is the “closed loop” approach taken by some chemical and cleantech companies: AkzoNobel takes back “used chlorine” from its customers; Umicore helps mobile phone and car manufacturers to include the recycling of products into the overall value proposition to B2B and B2C customers. Often this leads to new business concepts, for example leasing instead of purchase.

Use modular approaches to cope with complexity:

The need to be global and act local greatly increases the complexity of managing the business. We expect that companies will increasingly need to take a modular approach to business models – innovating such that different modules can be used as building blocks in a range of market environments, each supporting the overall strategy of the company.

One simple example of this is Unilever who employ the “Unilever Ladies” to distribute Unilever products to small villages.

Adapt business models to new markets:

Dealing with globalization requires a more significant effort than just “copy-pasting” the existing business model in a new market. Exporting an existing business model to a new market may not be successful. There is an important need for companies to find better ways to generate innovative business models proactively to meet the needs of new markets, or to respond to new developing world competitors, such as the developing “middle segment” of China and India.

3. frugal innovation / reverse innovation

Frugal Innovation, sometimes referred to almost interchangeably as ‘Reverse Innovation’, is all about originating and developing innovations in lower-income, emerging markets, taking the needs of poor consumers as a starting point, then transferring, adapting, applying and distributing them in developed markets. This is the opposite of the traditional innovation approach, which has been to develop innovations in the higher value “knowledge economies” of the developed world, to use the emerging markets as a low-cost manufacturing resource, and sometimes to strip the product or service of unnecessary cost and functionality to enable it to compete in the emerging markets.

A good example of frugal product innovation is the hand-held electrocardiogram (ECG) machine that was invented in GE’s Bangalore laboratory. It’s portable, light, battery- or mains-operated, reliable, cheap (40% of a conventional ECG). ECG test costs have gone down to a level (about $1 per ECG) that many people in industrializing countries can afford. Interestingly, after India and China, the product is now also launched in the US.

Frugal innovation brings about a rethinking of the nature of innovation. Instead of “more” it is often striving for “less”, using clever technology to create masterpieces of simplification in mobile phones, computers, cars and financial services. Frugal innovation clearly is not just about innovating products, often changes in the whole supply chain are involved.

Frugal Innovation has major implications for companies:

- Innovation systems rapidly have to implemented globally – you have to be where the shifting action is

- “Frugality” has to become a facet of the innovation mindset of every company (Philips’ “Sense and Simplicity” concept is an interesting example)

- More flexible and open-minded innovation approaches are needed as the “affordability” orientation becomes more important

4. High speed / low risk innovation

The drive to reduce time to market and selectively increase the speed of product cycles shows no sign of slowing over the next 10 years. One aspect that is set to become increasingly critical is the importance of getting to market not just fast, but also accurately and with no flaws. Due to the rise in global brands and the arrival of vivid, uncontrolled, ubiquitous mass communication, there is the potential for immense destruction of shareholder value from any flaw in product or service. We therefore expect to see further development of approaches and tools to drive fast, de-risked product and service innovation.

Here are some examples:

Trial and experiment

We expect to see ever-increasing use of the trial and the experiment, starting already in the functional specification phase. At the ‘fuzzy front end’ this will be through increasing use of virtual prototyping and immersive 3-D visualization software to develop both products and services. Lead customers will become ever more involved. Simultaneously we will see ‘open innovation’ become more sophisticated as lead customers become accepted as part of service and product delivery. Google and Microsoft are but two examples of organisations that have already embraced this.

Global 24/7 product/service development

Simultaneously we will see the maturation of a trend towards truly global innovation management teams. This will be supported by the continuing development of product design, management and prototyping tools. Global teams with virtual organisations will allow 24/7 development in pursuit of speed. More importantly they will allow a wider range of cultures and perspectives to be brought to bear in product creation. This will be vital as global platform products are customized for local success, marking the shift of the locus of power from developed economies to the emerging economies.

Gradual product roll-outs

We expect to see less dramatic big launches and more of a continuing roll-out when new products and services are released to their markets. Microsoft’s gradual launch of Office 2010 which progressed through beta trials and early versions that could be later upgraded to full versions was an example of this in practice. The approach reduces risk, both for the manufacturer and the user and will become crucial as systems become ever more complex and inter-related.

“In some cases, these developments can even be used to deliberately lengthen the product life cycles because a growing part of people is objecting to ever-shorter life cycles from a sustainability point of view. Also complexity management will be a regulating factor.”

– Professor Tom Sommerlatte

5. integrated innovation

Integrated Innovation is all about taking innovation approaches that were once the domain of New Product Development (NPD) only – such as idea management, stage gates and portfolio optimization – and applying them consistently as an integral part of business strategy to achieve not only growth but also competitiveness. We expect this to be a key focus over the next decade: our survey revealed that the proportion of CTO/CIOs who rate “integration of innovation into business strategy” and “seamless cross-functional innovation processes” High or Very High went up from some 30% over the last decade to around 90% for the coming decade, one of the highest increases in the survey.

There are several factors driving this integration.

First, companies are increasingly adopting team-based approaches to combine resources across traditional functional divisions such as Marketing, R&D and Manufacturing. This enables them to respond better to the ongoing blurring of product and service, ever closer customer involvement and the need for ever faster responsiveness.

Second, we expect that businesses will increasingly need to look towards more radical innovation in order to stay ahead of the pack: for example in our survey, CTOs expected the proportion of innovative new products in adjacent and new business areas to be nearly 3x as big as it was in the last decade:

Table 2: The importance of innovative new products in adjacent and new business areas

Such an increase would have fundamental consequences for the nature of innovation management, for example in the way that companies organize themselves to manage and assimilate such a rapidly growing portfolio of new products, services and businesses, often in untried markets and exposed to much greater risk.

Third, there is great scope for improvement in the application of formal innovation management approaches outside the realm of NPD. Business leaders are getting better at understanding innovation tools and techniques. Innovation, like other disciplines, is going through a maturity cycle. Approaches that were the realm of the specialist 10 years ago, such as idea management or strategic portfolio management, have become mainstream. The new challenges lie in how to apply these approaches effectively across the rest of the business.

In summary we see the following aspects of Integrated Innovation as being important for the future:

Innovation integral to business strategy

Many companies already claim innovation as being integral to business strategy, but struggle to explain exactly how this happens – more post-event justification than reality. As innovation tools, including especially radical innovation tools, become more embedded throughout the organization, we expect that leading companies will become much better at applying them more purposefully and effectively in a corporate strategy context

Systematic non-NPD innovation

This means greater and more consistent application of formal innovation tools and approaches to improve the effectiveness of proactive innovation in non-NPD areas such as management processes, manufacturing operations, business models, supply chain and sustainability. This will also include greater application of innovation management tools for cost reduction and competitiveness improvement: for example in our survey, in the next 10 years CTO/CIOs expected innovation to yield nearly double the equivalent reduction in unit costs achieved in the last 10 years.

Embedded innovation process ownership

We expect to see ownership of the innovation process shifting increasingly outside the Technology and R&D functions, ultimately becoming fully embedded in other business functions. We expect to see innovation performance being measured more explicitly across these functions, somewhat analogous to the way Quality management has evolved.

Radical/disruptive innovation: There will be a need for increasing proficiency and effectiveness in applying techniques to focus especially on radical innovation and new growth opportunities in adjacent or completely new business areas. This will entail finding ways to integrate innovation disciplines even further into business strategy.

Trends: more new business innovation, more global, and more decentralized

The next decade is set to be even tougher than the last in terms of the need for innovation, something the vast majority of global executives recognise. To stay competitive companies are going to have to up their game, especially in terms of innovation in adjacent/new business areas, and in managing the complexity of truly global, decentralized innovation resources:

New technology-based business development and venturing

This will take an ever-increasing proportion of their efforts, as companies strive to grow and maintain competitiveness through building products and services in adjacent and new business areas

Innovation process management

Companies will need to find new ways to manage their innovation process. The new processes will need to connect much more intimately with customers, to enable application of innovation holistically across the whole of the business, to increase speed to market, to enable development of new business models and to encourage new dimensions such as frugal innovation across a global innovation network

Knowledge management

Complexity, integration, speed and globalization all mean that excellence in knowledge management, including sources external to the company, is going to be more crucial than ever in the next decade.

Orchestrating decentralized competence centres

Companies’ investments in Innovation are becoming more and more global, primarily for companies in developed countries. Asia has seen by far the largest inflow of R&D investments from 13% in 2002 to 19% in 2007 of total world R&D expenditure, according to the UNESCO institute for statistics¹.

Insights for the executive

It is sometimes remarked that the only thing certain about the future is that it is uncertain. But as the writer William Gibson once said: “The future is already here – it just isn’t evenly distributed yet”.

Companies that want to stay ahead of their competitors in innovation management need to keep a close watching brief on these emerging hotspots – such as Customer-based Innovation, Proactive Business Model Innovation, Frugal Innovation, High Speed/Low Risk Innovation and Integrated Innovation, – and make sure they are well-positioned as they develop.

Those that will succeed will be those that are best able to integrate innovation systematically into all aspects of the organization, to drive a higher rate of innovation in new business areas, and to manage innovation resources effectively and flexibly in a truly globalized and decentralized world.

By Rick Eagar

About the author

Rick Eagar is a Partner of Arthur D. Little and head of the UK Technology and Innovation Management practice. He has extensive experience in technology, R&D, and innovation strategy and performance improvement work across a range of sectors, including energy, manufacturing, transport, engineering, food & drink and government.

Rick Eagar is a Partner of Arthur D. Little and head of the UK Technology and Innovation Management practice. He has extensive experience in technology, R&D, and innovation strategy and performance improvement work across a range of sectors, including energy, manufacturing, transport, engineering, food & drink and government.

Resources

1. Regional totals for R&D Expenditure (GERD) and Researchers, 2002 and 2007″ – Unesco Institute for Statistics, June 2010