By: IMP³rove Academy

The recent economic crisis has confronted companies across Europe with major challenges. Small and medium sized companies in particular seemed to have a customer base too reduced to maintain their business. In such a situation there are two options: invest in developing new customers or invest in developing new, more attractive, offerings.

The first option requires strong marketing and sales skills. The second option builds on strong innovation management capabilities to deliver new products, services or business models and usually has longer lead-times. Of course, the best option is to have both a broad high-potential customer base – ideally in different countries – and strong innovation management skills.

Export-orientation of innovative SMEs in Europe

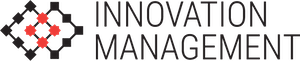

European companies that have benchmarked their innovation management performance based on the IMP³rove Assessment have proven their interest in innovation management. In total there were 1,801 companies analysed.

Figure 1: Overview on innovation oriented European SMEs by industry sector (Source: IMP³rove innovation management benchmarking database)

Taking a look at those countries with a sufficient number of companies in the database, the export champion is Germany. 67 per cent of the German companies have sales from exports, followed by Austria (56 per cent), Spain and France (46 per cent each). Hungary and UK have the lowest figure with 35 per cent. (See figure below)

Figure 2: Percentage of export oriented companies by selected European countries (Source: IMP³rove innovation management benchmarking database)

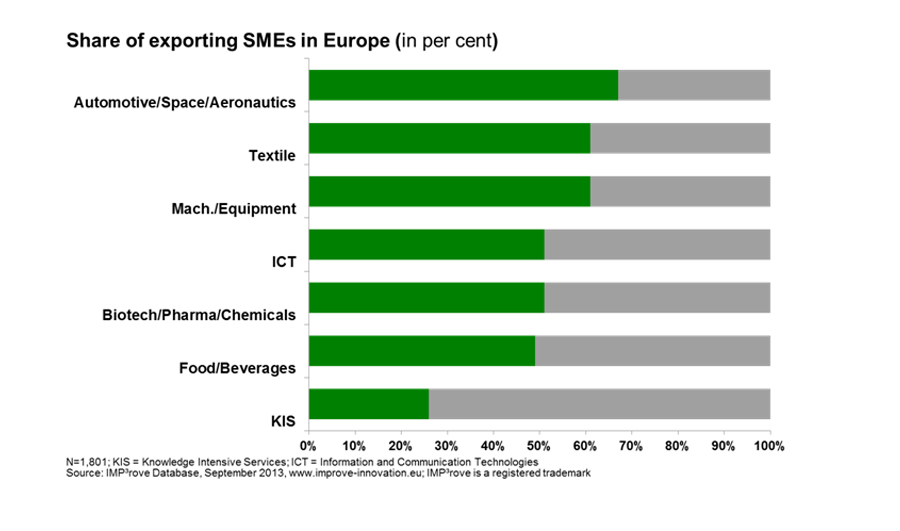

By industry sector, the group including Space/Aeronautics/Automotive has the highest share of companies that generate income from export sales with 67 per cent, followed by the sectors Textile (61 per cent) and Machinery/ Equipment (61 per cent). The lowest percentage of exporting companies is in the sector of Knowledge Intensive Services (KIS) with only 26 per cent. (See figure below)

Figure 3: Overview on percentage of European companies generating sales from export (Source: IMP³rove innovation management benchmarking database)

Knowledge intensive services seem to have a very national focus. There are several reasons for this. SMEs in the knowledge intensive service sector are rather small. 60 per cent have 20 or less employees. Since most services are rendered directly by staff members, there are simply not enough people. Apart from the customization of the services to the international markets, travel and appropriate language skills are required. Scaling the business beyond the national boundaries, therefore, requires for these SMEs either an international network of trained staff or well-trained own staff able to succeed in a multi-cultural environment. One key pre-requisite for working in an international environment is sufficient knowledge of the languages the international customers and business partners speak. The IMP³rove database shows that almost 95 per cent of the exporting companies in Europe speak English. However, these companies indicate that only 30 percent of their international partners speak English. The overlap in other European languages, such as French or German is even lower. Yet, the language skills are not the only success factor to get export ready as an innovative company.

Key success factors for innovative companies to get export ready

Exploiting innovation for international markets is a promising growth opportunity to counter the crisis provided following questions can be answered with yes:

- Is the company’s strategic ambition really in the international markets in the longer-term future?

- Does the company have the organisation and culture in place to think and act internationally or even globally?

- Are the requirements of international markets incorporated in the innovation life-cycle processes comprising idea management, development of the innovation, launch of the innovation and continuous improvement of the innovation for increased cumulative profit?

- Does the company have an international focus regarding intellectual property protection, trade regulations and policies?

- Is the company currently trying to maintain its competitiveness based on cost reduction or on profitable growth?

Strategic ambition to grow in international markets – with innovation

There is potential for European SMEs to build on innovation for internationalisation and on internationalisation for innovation

The decision to go international requires a profound analysis of the chances to succeed. This includes the assessment to what degree the trends that the company is already monitoring also apply for the targeted international markets. It also requires deep customer intelligence for effective market segmentation. Furthermore, a sober analysis has to take place whether the defined search fields and the core capabilities of the company will allow for a successful entry in the international market. This internal analysis needs to be complemented by the competitor analysis in the target countries and the evaluation of their unique selling propositions. Here not only the local competitors are to be monitored but also potential international competitors. And there needs to be an answer to the question: which channels and or partners are the most promising ones?

Even if the SME is obliged to follow one of their main customers a sober analysis of the possible return on investment in the new market should have a high probability of success.Once such a decision to go international is taken, significant investment in time, money and people have to be made.Therefore this decision needs to be well-founded and should not have to be revised short-term. The strategic decision will follow a clear plan, how the company intends to go abroad. A pilot with clear targets, budget, roles and responsibilities and deliverables will reduce risk, allow for learning how to operate abroad, and prevent the organisation from stretching the resources beyond the limits.

Capabilities to go international

The strategic decision to enter international market(s) often requires organizational changes. Who will be in charge of the international business? Will the company be organized by product lines or by geographies? Are there more synergies in the development of the next innovation if it will fit both the domestic and international markets?

Apart from the organizational issues, the cultural requirements need to be assessed. Of course the languages are a key pre-requisite. Yet as important are the insights in the access and entry points to the international markets. There are numerous services to support SMEs in their internationalization efforts. However, the company itself has to decide whether they have all the knowledge and skills available to develop the new foreign market. Starting such an endeavor on a small scale will allow learning and developing the skills and knowledge. Failure should be exploited to build knowledge and internationalization capabilities rather than blaming the ones who were involved in the internationalization project.

Think international when innovating

The strategic decision to internationalize has impact on the innovation processes. Already during the idea management phase the company should assess to what degree the selected ideas can contribute to profitable growth in the international and not just in the domestic markets. The same applies during the development of the idea into a new offering. What will it take to adjust the new product, service or business model so that it can successfully be introduced at home as well as abroad? Testing the idea and the prototype in different markets increases complexity. These additional cost need to be compensated by higher sales. If the time to market is delayed due to the fact that the testing with various customers takes more time, the business plan has to show higher sales that not only cover the additional investment. Hence, the time to profit should be carefully monitored to gain transparency on the complexity cost. Often the business partners in the foreign countries cause the delay in the time-to-market and the time-to-profit. Their agenda and priorities might not be fully aligned with the own innovation processes and pace. Additional coordination effort and re-scheduling of activities are time-consuming and frustrating.

Enabling the entry in international markets

Management’s ambition and the SME’s capabilities to innovate and internationalize will design the path to profitable growth

Pro-active project management is certainly an asset when going international with innovations. Legal requirements concerning necessary certification, import and export can become a show-stopper for the new offering if not considered on time and with the right level of profoundness. Frustration can be avoided if the agreement with the local business partners has been developed well in time with professional legal support that has the proven knowledge of the local rules and regulations. In addition, local habits, customs and preferences need to be considered in the design of the new product, service, business model or sales and distribution channels.

Innovation results from going international

Innovative companies that currently focus on process innovation to reduce cost might consider first reaping the results from better cost competitiveness. This will give them the strengths to re-enter the profitable growth path with innovative products, services or business models. Financial strength is essential as different payment and pricing schemes might result in unexpected cash-flow issues. Well planned, innovation for international markets will pay off – and maybe will help to master the next crisis even better.

About the author

Dr. Eva Diedrichs is senior consultant at A.T. Kearney, Top Management Consulting. She is Core Team member of the European Innovation and R&D Management Practice there.

Dr. Eva Diedrichs is senior consultant at A.T. Kearney, Top Management Consulting. She is Core Team member of the European Innovation and R&D Management Practice there.

She is the responsible project manager for the European Commission’s flagship project on innovation management called “IMP³rove”. She has managed numerous innovation management projects in various industries such as pharmaceutical industry, medical device sector, service industries and in the aero space and defense sector. She published several articles and monographs on innovation management, benchmarking, change management and strategic topics. She co-authored a book on core competencies and gave several speeches on success factors of innovation management at international conferences. She holds a PhD from the University of Bamberg, Germany and was a lecturer at St. Thomas College, St. Paul MN, USA.

Photo: holding a glowing earth globe in his hands from shutterstock.com