By: Ben Thuriaux-Alemán / Fredrik Härenstam / Rick Eagar

Most companies recognize the need for breakthrough innovation – it can change the fundamental bases of competition, “rewrite the rules” of an industry and transform the prospects of the successful innovator. There is no one-size-fits-all model for how best to respond to this challenge. Arthur D. Little surveyed over 80 large organizations to explore how to deliver a consistent pipeline of radically new products, performance features, business models and market space.

In today’s hypercompetitive and fast-moving world, breakthrough innovation is more important than ever. Examples of breakthrough innovations include LED lights, LCD screens, and hydraulic fracturing technologies in the oil and gas industry. However, systematically delivering a series of breakthrough innovations is extremely challenging for a number of reasons:

- By definition, breakthrough innovation involves pushing the boundaries of science and technology, with all the uncertainty and risk that this entails.

- In almost all cases successful breakthrough innovation requires know-how that may not already be present in a company, meaning that organizations must grapple with how to identify, assess, access and develop capabilities outside of their competence bases.

- Breakthrough innovations “change the rules of the game”. Analyzing the market potential of breakthrough innovations is therefore extremely difficult. It may be impossible to establish whether there is real market pull for a new solution, since customers struggle to articulate their interest in products that they did not imagine possible.

Breakthrough innovation is increasingly important, yet nearly all companies are unsatisfied with their performance

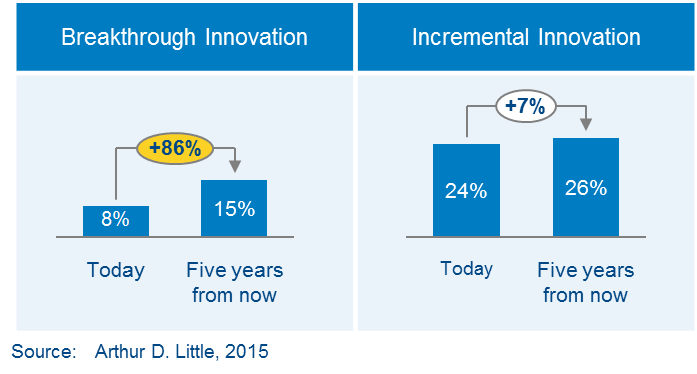

Companies expect the revenue contribution from breakthrough products and services launched over the last three years to double in the next five years, from 8% to 15%, but the contribution from incremental innovation will rise much more slowly. (See Figure 1.) Surprisingly, our survey revealed that 88% of companies were unsatisfied with their current breakthrough innovation performances, without a single respondent reporting being very satisfied. Improving breakthrough innovation performance is thus a high priority. The study revealed several key success factors.

Develop an explicit breakthrough strategy with clear and quantified long-term goals and dedicated resources

Although nearly 90% of companies recognized the importance of defining specific strategic objectives for breakthrough innovation, only about half reported currently doing so. Those that did were, on average, nearly four times more satisfied with the results than those that did not, and the more explicit the goals, the higher the success rate. We also found that companies with more experience of working with breakthrough innovation in a structured way had more explicit objectives than others. In addition, the more successful companies had specific target allocations for the resources they expected to dedicate.

The time frame of breakthrough projects can be long, which poses challenges to sustaining commitment versus other, shorter-term priorities. Over half of the survey participants quoted average time to revenue of between three and 10 years for breakthrough products and services. The main challenges quoted were conflicting short-term and long-term needs, and difficulties in assessing future value. This further underpinned the need to set clear goals and challenges to overcome, and to set out a stable investment plan with dedicated resources, at least for the coming key stages of a program.

Ensure single-point accountability and commitment at top management levels

The top-quoted challenges were inability to commit to the cause and allowing short-term objectives to cannibalize breakthrough efforts.

Half of the participating companies regarded their breakthrough innovation leadership and governance structures as ineffective or very ineffective, including both experienced and less experienced practitioners. The top-quoted challenges were inability to commit to the cause and allowing short-term objectives to cannibalize breakthrough efforts.

What sets successful companies apart is not the choice of leadership model – leadership by the CEO, the CTO, an innovation council or committee, and the top team are almost equally adopted. The main differentiator that emerges is whether the company employs a governance approach that ensures long-term accountability and commitment.

Choose the right organizational model: there’s no one-size-fits-all

Having a dedicated breakthrough team is considered the most effective basic approach and yields 15% higher satisfaction than is found in companies with no dedicated organization. Working with a dedicated team is also the choice of the more experienced companies. Crucial to any dedicated team’s success, however, is that it is implemented in a way that suits the nature of the issue at hand. (See Figure 2) The complexity and novelty of the technology, product or service for the company can provide some guidance on the best way to organize breakthrough teams.

For example, if the domain is known to the organization, the R&D function or an existing business unit may be the best home for the breakthrough team. If it is unknown, stand-alone teams may be more suitable. Similarly, if the domain is highly technology intensive or complex with high investment needs, a centralized rather than divisional or business-unit approach may be preferable. Large companies may, and often do, choose to use more than one model simultaneously.

We identified four generic organizational models that are effective in different circumstances:

- Business unit/division R&D breakthrough teams are good “minimum investment” options in which the ideas or concepts are not “new to the world”, and the technical complexity does not require major long-term effort and investment. Such a team is, however, unlikely to be able to cope with high complexity and risk, and susceptible to short-term business-unit reprioritization pressures.

- Corporate R&D breakthrough teams are better suited to more technology-intensive or higher-investment domains in which a longer-term perspective and specialist technical skills are required. However, teams parented under corporate R&D are susceptible to over-emphasis on “technology-push”, becoming misaligned with the business (“ivory tower” syndrome), and being stifled by corporate control and culture, which may act as major barriers to breakthrough thinking.

- Internal dedicated breakthrough teams with multifunctional membership, separate from corporate R&D and reporting directly to the top team, enjoy the freedom to operate outside core product development procedures and controls. They may be more effective in pursuing areas of uncertainty that require greater stretch, but they also need careful governance to avoid becoming disconnected from the business, and to ensure that they deliver short-term value. They are often susceptible to cuts as a result of short-term pressures.

- The breakthrough factory focuses on development of a pipeline of “grand-challenge”-led radical or game-changing innovations that push the boundaries of science. It mainly uses external hires with time-limited contracts, led by an internal senior project leader with deep technical or scientific knowledge, as well as entrepreneurial capabilities. This model is especially effective in technologically complex domains with high uncertainty, where faster progress is needed. Time limitation means that the best individuals can be hired on merit, even if they don’t fit the typical corporate profile. Google ATAP and DARPA are based on similar structures.

Ensure cross-functionality, ring-fenced funding and use of “intrapreneurs”

Whichever model is adopted, the survey revealed a number of key success factors for making it work effectively:

The more successful companies actively engage and involve cross-functional resources, rather than simply having cross-functional steering groups.

- Cross-functionality: Ensure genuine co-involvement of a wide range of functions, including research & development, manufacturing, marketing and customer insight. Successful companies engage and involve cross-functional resources, rather than simply having cross-functional steering groups.

- Ring-fenced funding: Establish ring-fencing to enable stable investment over the longer time frame needed for breakthrough projects and prevent short-term cannibalization. Staged funding release can help to manage the risks involved.

- “Intrapreneurs”: Employ and encourage strong “intrapreneurs” as breakthrough leaders to drive concepts through to commercial exploitation. Intrapreneurs, like successful entrepreneurs, are individuals with the ability pursue a commercial vision with dedication, inspire others to join the cause, take measured risks and shepherd an effort through to market, securing needed resources along the way.

Focus on effective trend monitoring and business intelligence

Trend monitoring and business intelligence were rated as the most important and widely used practices to achieve breakthrough results. Traditional approaches to business intelligence involving periodic data gathering and analysis are rapidly being superseded by more sophisticated Internet-based tools. Examples include continuous semi-automatic scanning using algorithms, natural language processing, modeling and simulation, and two-way processes whereby information is shared as well as retrieved. Successful breakthrough innovators make adding to their knowledge a habit, in the same way that top innovators use external sources of business intelligence in structured ways:

Adopt agile processes with fast iteration cycles

Successful breakthrough teams apply agile processes, drawing on approaches used effectively by start-ups. In practice this means firstly being crystal clear about the goal and the technical challenges that must be overcome to achieve the goal. Rigorous quantitative analysis is often required to do this. Secondly, planning should be light and agile, involving several iterations with fast and purposeful meetings (i.e. “scrum” approaches).

Thirdly, where possible, teams should adopt rapid prototyping and try to engage customers early with fast repetition (“build-measure-learn”). Progress is best assessed by tracking iterations to see how they are converging on goals, revealing dead ends, uncovering scientific advances, etc. Fourthly, projects should be killed in a timely way. Setbacks and failures are sometimes the most effective tools for discovery. The project leader should only let the team members proceed if they can see that the approach might ultimately work within the project constraints. If it becomes clear that an approach won’t work or requires “multiple miracles”, then the approach should be shut down and resources shifted elsewhere.

Actively manage the innovation ecosystem

The best performers… recognize that working within the ecosystem is a two-way process – much more than just contracting out some research projects to a university.

Companies in the survey indicated that active management of external networks and partners was very important for successful breakthrough innovation, yet, on average, most were either only partially satisfied or unsatisfied with their efforts.

The best performers in this area have a clear strategies for innovation ecosystem management and its contribution. They recognize that working within the ecosystem is a two-way process – much more than just contracting out some research projects to a university. They work to develop a shared vision within the ecosystem, and they agree transparent IP arrangements and frameworks, remaining open to sharing information once these are in place. They look to lead and influence the ecosystem in the most business-critical areas, and they use the right “enablers” to develop and manage the network (e.g. social networking, virtual environments and physical collaboration spaces).

Fail again, fail better: move on and make an effort to leverage the lessons learned

Individuals involved in breakthrough efforts are encouraged to stretch themselves beyond their comfort zones in environments that allow failure. Our findings confirm that a culture that does not accept failure is one of the most significant barriers to achieving breakthrough innovation. “Infant mortality” is fairly high among radical concepts – most concepts do not make it to “adulthood”. This is normal and should be recognized early on. The key to success is to have a portfolio approach to breakthrough innovation and ensure that the there is always another project to move on to.

Conclusion

Breakthrough innovation requires creativity – but creativity needs the right management framework in order to flourish. If you’re like the 88% of companies in our survey that were unsatisfied with their current breakthrough innovation performances, isn’t this something that deserves urgent attention?

Our survey shows that there is still a long way to go before companies’ efforts match their aspirations. Although there is no single formula for success, it is clear that there are some important key factors.

The first prerequisite is having a well-defined breakthrough strategy and goals. Clear top management accountability and commitment are essential. A company needs to choose the right organizational model for the breakthrough team to suit the nature of the business and its challenges. And it needs to have the right approaches for funding, involvement of multiple functions, intrapreneurship, ecosystem management, agile processes and encouragement of creativity. With all these components in place and unflinching top management commitment, the evidence shows that serial breakthrough innovation is real and achievable for any company.

The original study can be located at http://www.adlittle.com/breakthrough.

By Ben Thuriaux-Alemán, Fredrik Härenstam & Rick Eagar

About the authors

Ben Thuriaux-Alemán is a principal in Arthur D. Little UK with 18 years of consulting experience. He works in R&D, technology and innovation management. Ben has an MBA from RSM and Chicago GSB, an MSc in science and technology policy, and a BSc in physics. In addition to client work in innovation management, he has led a number of ADL studies on innovation and technology management.

Ben Thuriaux-Alemán is a principal in Arthur D. Little UK with 18 years of consulting experience. He works in R&D, technology and innovation management. Ben has an MBA from RSM and Chicago GSB, an MSc in science and technology policy, and a BSc in physics. In addition to client work in innovation management, he has led a number of ADL studies on innovation and technology management.

Fredrik Härenstam is a consultant in Arthur D. Little Nordic and has worked with strategic, innovation governance, and operational issues in a variety of industries including telecom, healthcare, and automotive. Fredrik holds an MSc in industrial engineering from Chalmers University of Technology and has a background in photojournalism.

Fredrik Härenstam is a consultant in Arthur D. Little Nordic and has worked with strategic, innovation governance, and operational issues in a variety of industries including telecom, healthcare, and automotive. Fredrik holds an MSc in industrial engineering from Chalmers University of Technology and has a background in photojournalism.

Rick Eagar is a partner in Arthur D. Little UK, where he leads the Technology and Innovation Management (TIM) Practice. He has over 24 years of consulting experience in R&D, technology and innovation management, and 10 years in industry. He has a BSc in mechanical engineering from the University of Bristol and is chief editor of Arthur D. Little’s management journal, Prism.

Rick Eagar is a partner in Arthur D. Little UK, where he leads the Technology and Innovation Management (TIM) Practice. He has over 24 years of consulting experience in R&D, technology and innovation management, and 10 years in industry. He has a BSc in mechanical engineering from the University of Bristol and is chief editor of Arthur D. Little’s management journal, Prism.