By: Vani Jain

While innovation is crucial for driving customer engagement and increasing share of wallet, companies continue to struggle with the “what” and “how” of it. For each best-practice organization that has streamlined its innovation processes, there are many that are still paralyzed by their haphazard approach toward identifying and evaluating ideas. Evalueserve interacted with many of its Fortune 100 clients and identified six strategies that enhance the likelihood of developing successful innovation programs.

Large organizations target organic growth of 4-6% per annum. Achieving this is a herculean task even for global companies that generate billions in net sales. As a company grows in size, the key question that reaches the CEO’s desk is how to sustain a high growth rate. While traditional wisdom would suggest a volume game (selling more to an existing consumer base), ambitious risk takers would rather explore newer markets and consumer segments through innovative products, processes, or business models.

Best-practice organizations typically follow a process-oriented approach to innovation. This process comprises front- and back-end innovation activities (summarized in Figure 1) that are capital intensive, carry a high risk of failure, and often do not guarantee returns. Technology teams have thus been finding it difficult to justify the billions that go into product development. As companies try to bridge the gap between their top and bottom lines, they realize that they cannot rely on in-house innovation alone to remain viable. Instead they must scout for ready-to-commercialize innovations through alliances with external and internal partners, to cut R&D bills while maintaining high innovation rates. This process of supplementing internal know-how with capabilities/ideas sourced from external partners is known as open innovation (OI).

Evalueserve supports the innovation and product development teams of numerous Fortune 100 companies across the innovation value chain, through its unique combination of research, analytics, and intellectual property services. Across the organization, we have executed over 1,000 technology landscape and innovation scouting studies to help companies identify the next big whitespace, plan innovation pipelines, scout for technology solutions, and identify potential partners for product co-development/roll-out. We have closely studied what works and what does not, to identify the best practices for companies running innovation initiatives. These best practices are summarized in Figure 2.

1. Setting Up Dedicated and Cross Functional Innovation Teams

The processes across the innovation value chain require significant cross-functional involvement – sales and marketing gather specifications/needs (evaluate white spaces) through numerous consumer interactions; R&D identifies possible technology solutions to meet those specifications/needs; and manufacturing, engineering and packaging convert a concept into a scalable product.

However, individual domain experts may lack the knowledge required to combine functional expertise to develop marketable products. Therefore, it is essential to ensure collaboration across the product development value chain to translate concepts into tangible products. For a successful innovation program, companies must develop collaborative teams that exhibit an entrepreneurial spirit, are functionally diverse, and are not prone to functional fixedness (i.e., they have a unique perspective of the problem and can connect the dots differently compared with other people). An ideal structure for a cross functional innovation team is shown in Figure 3 below.Many best practice organizations have initiated programs that provide cross-functional skill sets to stakeholders across the product development value chain. Nestlé launched the Micro R&D MBA program for its R&D middle management. The program, aimed at improving business know-how and entrepreneurial skills, helped the management identify and implement real innovation.

By combining expertise in business strategy and technology, companies can identify ideas that have a higher likelihood of success, and can subsequently direct resources to bring these ideas to fruition.

2. Creating Innovation Portals

For a successful innovation program, companies need to be both proactive and reactive. They should not only search for new technology to accelerate NPD initiatives but also maintain a repository of open problems for potential partners/suppliers to co-develop solutions. They can do so by maintaining multi-purpose innovation portals.

Dedicated websites or portals make it easy for companies to communicate with the outside world in an efficient and timely manner. Pramod Reddy, an associate director at P&G said that the key benefit the company’s C+D portal offered was to consolidate all innovation leads (in over 7 different languages) in a single location to “…avoid swirl and parallel efforts in the innovation program,”. Further, Mr. Reddy also mentioned that the portal helps P&G track historical records (since the company maintains this database over the past years) and identify suppliers that have made multiple attempts to reach out to the company through different channels.

Like P&G, General Electric too maintains a dedicated website that publicizes its technical needs and invites solutions from experts, entrepreneurs, scientists, and other stakeholders (such as customers and contract manufacturers) around the world. Further, it launched the “Ecomagination Challenge” to identify innovation in the domains of renewable energy, grid efficiency and energy consumption. The company created an online system through which it sourced over 5,000 ideas and business plans from 85 countries.

To manage the deluge of ideas through crowd sourcing/open innovation portals, companies are outsourcing the screening process to organizations such as Evalueserve. Third-party research firms use their strong analytical capabilities in multiple languages as well as technological innovations to provide fast and efficient support. This enables R&D teams to focus only on ideas that meet their requirements, besides other strategic and tactical activities.

3. Building Innovation Networks and Global R&D Presence

Traditionally, companies have been launching innovations in their high-value markets before transferring to low-value markets on achieving economies of scale. However, as the innovation paradigm shifts from “Think Global, Act Local” to “Think Local, Act Global”, corporate houses need to geographically distribute their OI and R&D hubs across key target markets.

As emerging markets are likely to generate significant value in the coming years, companies must understand their needs and expecta- tions, and correlate them to the innovation eco-system. This is especially true for consum- er-centric industries such as CPG and consumer electronics.

4. Digitizing the NPD Value Chain

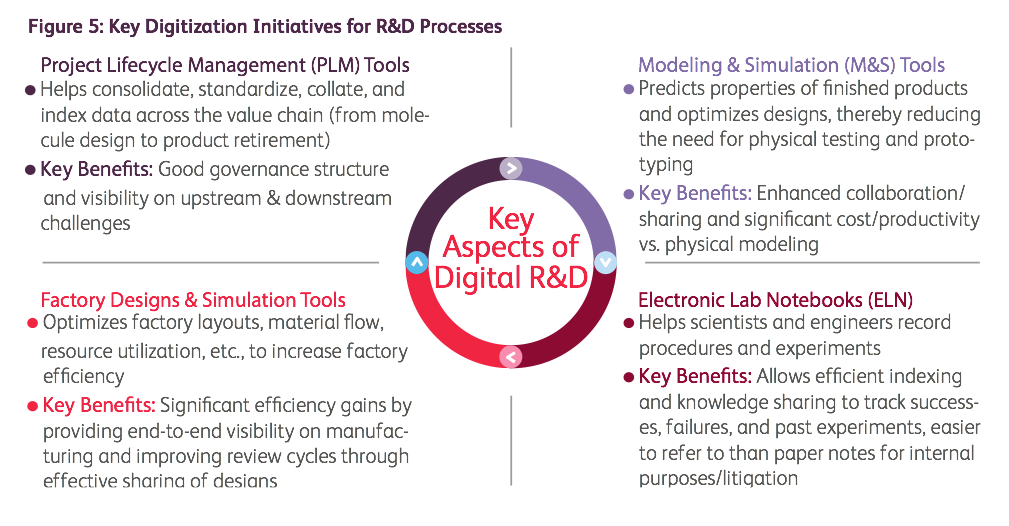

Digitization not only shows “one version of truth” to all stakeholders across the value chain (corporate strategy, marketing, R&D, and engineering), but also acts as a key enabler for innovation teams, from a project management perspective. (See Figure 5)

Companies with large R&D teams and innovation networks find it difficult to track responsibilities, analyze successes and failures, and share learnings. To cope with this problem, companies such as Clorox have developed internal portals (CloroxConnects) for com- munication and collaboration with partners and also uses a SharePoint based application for knowledge management. Navin Kunde, a business networks leader at Clorox says, “…the CloroxConnects portal is the single source of truth for supplier and partner conversations; everyone involved can see what is going on and can provide input. This fosters efficient collabo- ration by reducing the bottlenecks that tend to form during person-to-person discussions.”

Companies should therefore digitize product development efforts to increase the visibility of data generated across the product development value chain, as well as to enhance idea management.

5. Assessment of effectiveness of Innovation programs

Companies should fix well-defined evaluation parameters to measure the success of their innovation initiatives and benchmark them against those of competitors. Typically, the assessment involves computation of ratios associated with:

- Percentage of sales generated through NPD

- Percentage of net sales invested in R&D

- Time invested by key stakeholders

- Number of patents filed or granted over a specified timeframe

Examples of innovation tracking measures (identified through Evalueserve’s interactions with organizations across industries)

- R&D Innovation Efficiency – Ratio of sales from new product launches and total expenditure on R&D

- Return on Innovation Investment – Ratio of gross profit earned from innovation and the cumulative investment period

- Innovation Success Rate – Ratio of ideas commercialized to the total number of ideas

- New Product Success Rate – Measured against a set of target parameters that include consumer acceptance, technical acceptance, and gross margins

- Consumer Satisfaction Index – Measured through consumer surveys to assess product performance, effective- ness of marketing activities, and response to FMOT/SMOT

- Break-even Analysis – Detailed P&L to estimate the expected time to recover investments made in NPD through product sales.

Evalueserve conducted an independent study to identify benchmarks that leading players across industries were using to measure the success of their innovation programs. Some indications on the findings from this exercise are summarized in the framework below.

6. Development of organizational culture to support innovation

“…Besides processes, the softer aspects on how new ideas are really perceived and accepted in an organization is one the key enablers for innovation,” says Donald Frey, a beauty industry veteran with R&D experience across corporates such as P&G, Avon, and Method Products. Navin Kunde from Clorox also echoes similar thoughts – he says that a simple way to build a culture of innovation is to connect business leaders and project teams to relevant external experts quickly and inexpensively, so they can experience open, “boundary-less”, innovation first-hand.

These aspects are extremely important to consider because intrinsically, large organiza- tions have significant resistance to change; the reward systems at these companies do not factor in the high chance of failure associated with working on disruptive ideas. Middle managers thus have very little incentive to take controlled risks and connect the dots differently, compared with others.

The key factors that should be communicated top down by the senior management to ensure innovation at the core of an organization are summarized in the framework in Figure 7.

One of the most well-known successes of “innovation without borders”, i.e., leveraging the expertise of stakeholders both within and outside the organization for product development, is P&G’s Connect+Develop initiative. A Harvard Business Review article (Con- nect+Develop: Inside Procter & Gamble’s new model for Innovation) discusses their success story – P&G leaders realized that for each of the 7,500 team members that worked in their R&D organization, there were ~200 external stake- holders who were just as capable and working on similar problems. By leveraging the expertise of external partners, P&G realized that they could create a talent pool of 7,500 internal and 1.5 million external stakeholders.

P&G’s Connect+Develop initiative helped the company dramatically improve its innovation success rate to emerge from the slump it faced in early 2000s. Connect+Develop enabled P&G to build partnerships and systematically source tangible ideas for its brands. The outcome was a 40% jump in innovation from external sources; it increased from 10% to more than 50% between 2001 and 2008. The company was thus able to launch numerous flagship products such as Tide Pods, Olay Regenerist, Crest White Strips, and the entire Swiffer line.

Consequently, to run successful innovation programs, the focus of companies should be three-fold:

- Leverage innovation networks of internal and external partners to increase the influx of ideas and ready to use solutions to business problems

- Ensure visibility across the entire innovation value chain and set up processes to track the success of innovation initiatives so that innovation project managers can anticipate downstream challenges and make informed calls on go no-go decisions.

- Understand that the reward systems for teams working on disruptive ideas are different from those that are followed by the rest of the company – Organi- zations must work to create a collabo- rative start-up like environment so that innovation teams can collaborate across functions to drive new ideas to fruition.

By Vani Jain

About the Author

Vani Jain, An associate vice president at Evalueserve. Vani leads the company’s global Consumer Goods practice, which supports several Fortune 100 CPG companies. She has over 10 years of experience in the CPG and retail space. Along with her team, Vani works extensively for several corporate strategy, new product development, open innovation, market intelligence, marketing, and R&D teams. Her team offers a range of solution sets, from category innovation planning, technology/partner scouting, route-to-market strategies, business/technical competitive Intelligence, advanced analytics, to data management.Vani’s team recently won an Innovation capability award from P&G.

Vani Jain, An associate vice president at Evalueserve. Vani leads the company’s global Consumer Goods practice, which supports several Fortune 100 CPG companies. She has over 10 years of experience in the CPG and retail space. Along with her team, Vani works extensively for several corporate strategy, new product development, open innovation, market intelligence, marketing, and R&D teams. Her team offers a range of solution sets, from category innovation planning, technology/partner scouting, route-to-market strategies, business/technical competitive Intelligence, advanced analytics, to data management.Vani’s team recently won an Innovation capability award from P&G.