We’ve seen early hit products, like the Fitbit activity monitor, the Nest learning thermostat, the Sonos digital music system, and Amazon’s Echo speech-driven assistant, released in late 2014 and now estimated to have sold more than three million units.

Industrial deployment of connected products and services is ahead of consumer use, by all assessments. Recently, General Electric CTO Harel Kodesh predicted that within the next decade, we’ll see “self-healing, self-optimizing” factories, which will have humans monitoring them, instead of manning the machinery.

Let’s imagine that a large percentage of consumer and B2B products costing more than $25 will soon have some kind of connectivity built into them. That will enable them to provide all kinds of data that might be useful for maintaining them, insuring them, financing them, or designing their replacements — from how often they are being used, to where, to what breaks down first. It creates a feedback loop of information that can build a stronger bond of loyalty between producer and user, as well as potentially generating more revenue (and also better products and services) over time. Who wouldn’t want to be part of that loop? But that’s the decision that companies are making, in 2016, by cranking out products that have no connectivity, no supporting services, no data streams.

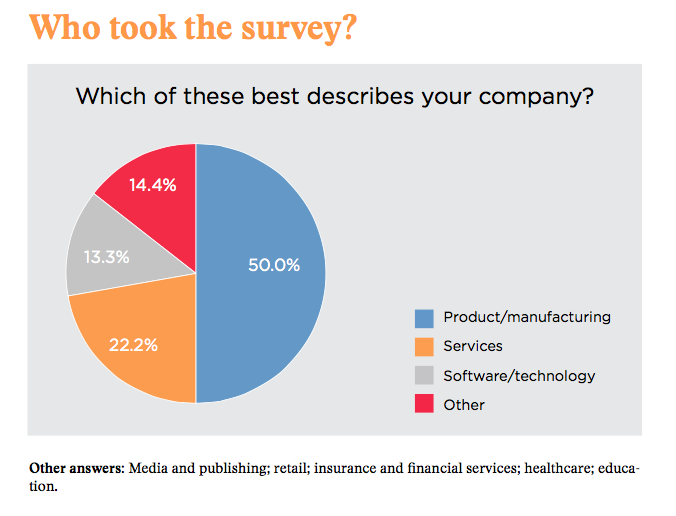

In Q3 2016, we surveyed companies active in, interested in, or developing connected products, in collaboration with the design and innovation consulting firm Altitude. We heard from 92 executives. While the majority told us they were still exploring opportunities and hammering out a strategy, 36 percent said they’d already launched a product. (The rate was even higher among the companies that described themselves as software or tech providers; there, about half of respondnts had already launched a product.) Of the companies that have some experience in the market already, 67 percent described the product as either meeting or exceeding their expectations. Just 18 percent said it had under-performed.

But we also heard about challenges that were keeping more than half of our respondents on the bench, rather than on the field, such as:

- Articulating the ROI or business case

- Understanding the consumer and creating a simple user experience

- Coordinating partners or other players in an ecosystem

- Support or resources from senior leadership

- The need for cultural changes, or the development of new capabilities

- Concerns about data security, usage, and privacy.

Respondents told us that their companies need to be “open to new business models” and “continue to develop a culture of experimentation with a purposeful disregard for existing processes.” They see a need to “substantially grow our development and prototyping capabilities,” bring in new talent, better understand customer needs and desires, and be “more willing to take risks and innovate.”

In short, there is an opportunity for internal innovation leaders — whether they work in R&D, strategy, design, marketing, or other groups — to play a major role in positioning their organizations for success in the world of connected products and the services that will surround them.

About Altitude

Altitude, an award-winning design and innovation consulting firm, creates people-centered products and experiences that help companies grow. Our strategists, designers and engineers use a De- sign Thinking approach to uncover new opportunities, generate ideas, and develop new offerings to bring our clients success. Since 1992, Altitude has worked with companies worldwide, including Anheuser-Busch, Bose, Black & Decker, Briggs & Stratton, Colgate-Palmolive, DeWalt, Margaritaville, Nike, Thermo Scientific, and Under Armour.

Altitude, an award-winning design and innovation consulting firm, creates people-centered products and experiences that help companies grow. Our strategists, designers and engineers use a De- sign Thinking approach to uncover new opportunities, generate ideas, and develop new offerings to bring our clients success. Since 1992, Altitude has worked with companies worldwide, including Anheuser-Busch, Bose, Black & Decker, Briggs & Stratton, Colgate-Palmolive, DeWalt, Margaritaville, Nike, Thermo Scientific, and Under Armour.